The EURJPY exchange rate again traded at the previous intervention levels, with European data ahead.

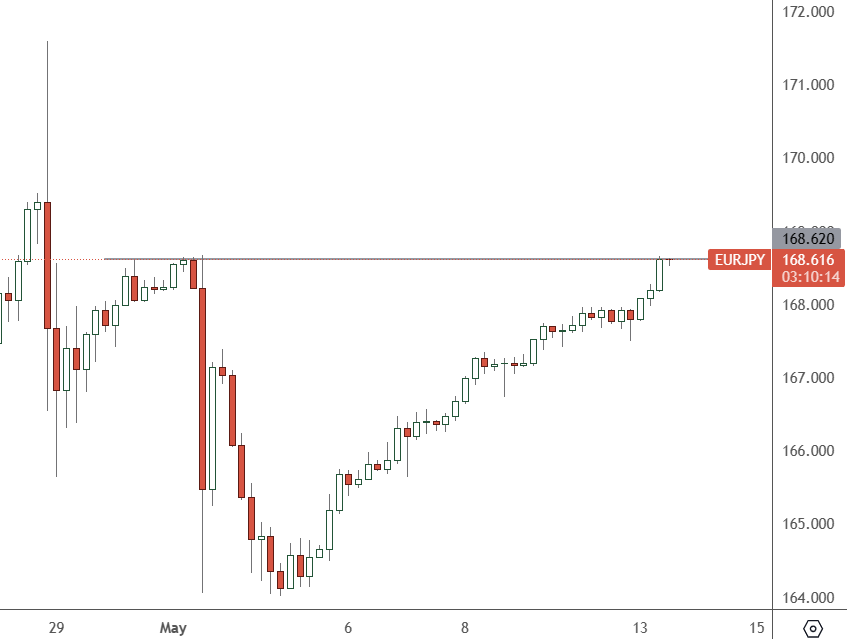

EURJPY – Daily Chart

EURJPY trades at 168.62, where the second BOJ intervention occurred, and investors should be wary of euro longs here.

The Japanese economy will release data on Tuesday, with PPI numbers released at 7:50 a.m. HKT. That will be followed by German inflation at 2:00 p.m. HKT, when analysts expect the German price level to be flat for the month.

Any significant move could come from higher Japanese PPI levels, increasing the chances of rate hikes from the Bank of Japan.

However, any yen selling here would be risky as another intervention in the currency market is likely inevitable. BOJ officials were talking tough again last week about the yen’s weakness, but selling continues. The yen surged at the end of April and again on the first day of May after the BOJ intervened in the currency market.

Bank of Japan Governor Kazuo Ueda indicated last week that he would consider early interest rate movement if inflation exceeded the central bank’s expectations. He spoke at an event with the Yomiuri International Economic Society, where Ueda acknowledged the possibility of higher inflation prompting monetary policy changes.

Ueda said that if price expectations were significantly revised upward or potential inflation risks grew, the Bank of Japan would consider making appropriate early adjustments to interest rates.

The Bank of Japan’s March decision to terminate unconventional easing measures, including negative interest rates, marked a shift in its policy approach due to changing economic conditions. Ueda said that although core inflation appears to be progressing towards the bank’s 2 percent target, uncertainties remain regarding the interest rate trajectory.

Ueda noted again that the bank is vigilant to the impact of yen depreciation on core inflation, signalling a readiness to intervene through monetary policy measures if needed. He acknowledged that fluctuations in currency rates now have a more pronounced effect on prices than in previous periods.

Other BOJ officials have stressed that a weaker yen puts pressure on businesses and will not be tolerated.