Alibaba (NYSE:BABA) shares rose with the broader market and the company has announced new AI initiatives.

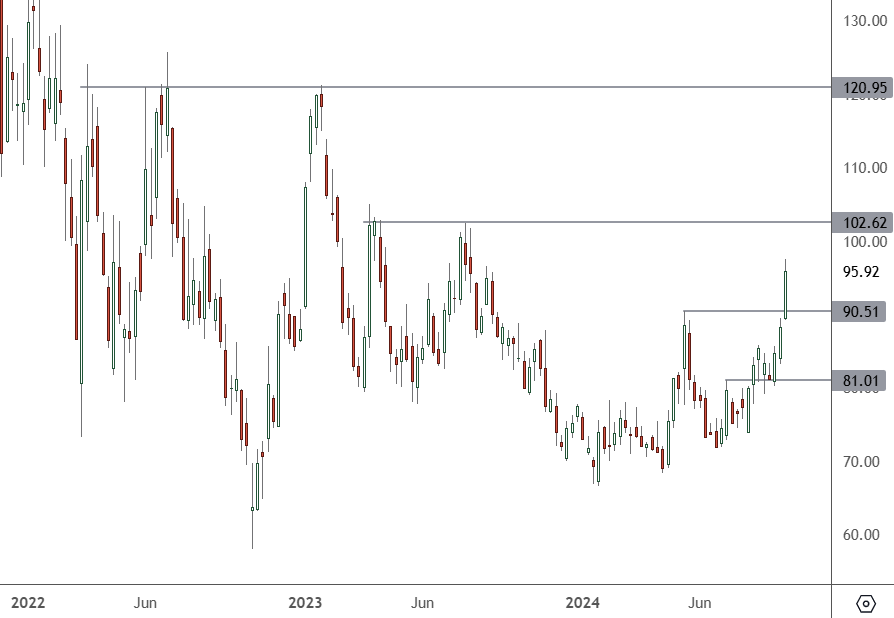

BABA – Weekly Chart

BABA shares have broken above the $90.51 level on the ADR and the next target for the stock is at $102.62. A strong close above that level can open up the $110-120 levels.

Alibaba Group’s cloud computing unit and semiconductor heavyweight Nvidia are collaborating on an artificial intelligence (AI) initiative to enhance the autonomous driving experience for Chinese EVs.

Alibaba Cloud, the digital technology unit of the e-commerce giant, announced the collaboration last week, alongside an AI model aimed at automotive applications that it co-developed with Nvidia and start-up Banma Network Technology, Alibaba’s intelligent cockpit solution provider, at the Apsara Conference that runs until Saturday. Alibaba owns the South China Morning Post.

The move marks the first integration of Alibaba’s AI models into Nvidia’s Drive platform, which major Chinese electric vehicle (EV) makers, including Li Auto, Zeekr and Xiaomi.

Nvidia’s model acceleration technology has already significantly reduced computational costs and minimised latency in the real-time processing of complex tasks by Alibaba Cloud’s AI models. This ensures a smooth and uninterrupted intelligent experience for both drivers and passengers, according to Alibaba Cloud.

“Together with our partners, we want to empower more businesses and individuals to unlock the potential of generative AI,” Alibaba Cloud chief technology officer Zhou Jingren said at an event.

As part of Alibaba’s LMM platform, its Cloud Mobile Agent will enable vehicle owners to execute voice commands, such as ordering food and drinks through a food delivery app.

Strict US export controls have halted Nvidia from selling its most advanced graphics processing units to Chinese firms, but the company still has a thriving customer base on the mainland.

For Alibaba, the company will look to shrug off the negativity surrounding Chinese equities this year as the government draws a line in the sand over equity market losses. Alibaba will look to catch up to its US peers such as Amazon. The US e-commerce giant trades at 3.2x annual sales, while Alibaba trades at 1.58%. The company could close that gap if the PBoC continues to support the market.