上週,由於美國通脹數據略弱於預期,美元兌加元在1.3835處遇到阻力位。

週三是加拿大經濟的轉折點,因為將公佈通脹數據,支撐位下移200點至1.3500。

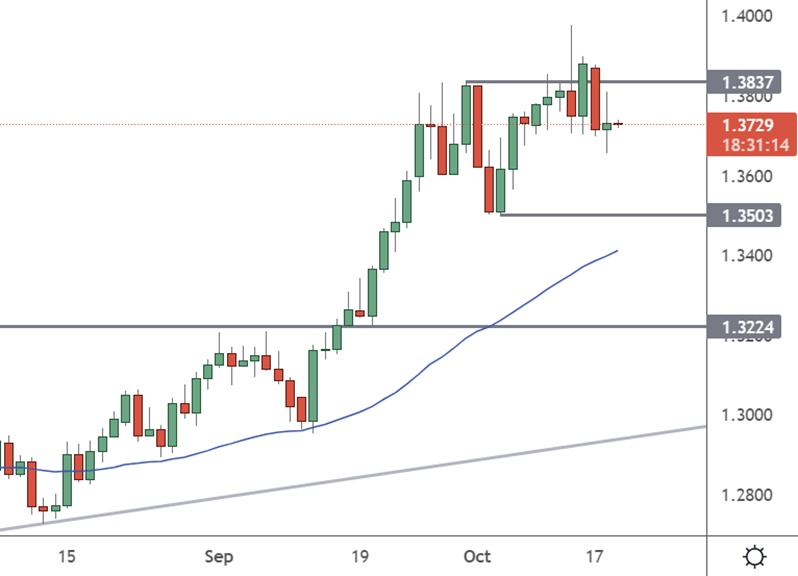

美元/加元日圖

如果數據上升,則可能導致加元上漲,如果交易員認為加拿大央行還沒有結束加息。在上次會議上,歐央行將利率從3月份的0.25%上調至3.25%。

一些分析人士認為,國際貨幣基金組織低估了加拿大經濟的潛力。牛津經濟研究院表示,利率上升以及資產和房價下跌帶來的財富損失,將影響發達經濟體。

國際貨幣基金組織估計,2023年的全球增長將出現與2019年類似的疲軟,但不是災難——全球衰退或可以避免。相比之下,我們的預測更弱,我們認為全球經濟正處於衰退的邊緣,”牛津經濟學院全球宏觀研究主任Ben May指出。

該組織將美國和加拿大視為麻煩地區,稱“我們對美國和加拿大的相對悲觀情緒尤為明顯。 ”根據牛津大學的預測,加拿大的經濟赤字可能會比美國或英國更嚴重。

大多數分析人士認為,加拿大的主要威脅來自房地產市場。凱投宏觀的保羅•阿什沃思表示:當利率迅速上升到10年來從未見過的水平時,情況可能會崩潰。就加拿大而言,最大的風險仍然隱藏在顯而易見的地方——長達十年的房價大幅上漲以及隨之而來的家庭債務激增。

阿什沃斯認為,房價的下降雖然緩慢,但可能不會一直維持這種轉態。

他說:“最大的風險仍然是,房地產和實體經濟之間(經濟衰退推高失業率,引發抵押貸款違約上升)或房地產和金融體系之間(房價下跌引發抵押貸款機構虧損,導致信貸環境收緊)形成負面反饋循環。 ”

麥格理的經濟學家認為,隨著更高的可變利率和固定利率抵押貸款的影響達到頂峰,住房問題將在2023年加劇。預計加拿大在2023年將遭受比美國更嚴重的衰退,失業率將上升~ 5個百分點,實際GDP將收縮3%。

儘管有這些中期不利因素,但短期內的問題將是通貨膨脹。如果數據走高,美元兌加元近期的回調可能會加速,市場正從主導了一整年的美元強勢中抽身。