The S&P 500 has formed a hammer candle at previous resistance levels and faces an important week ahead.

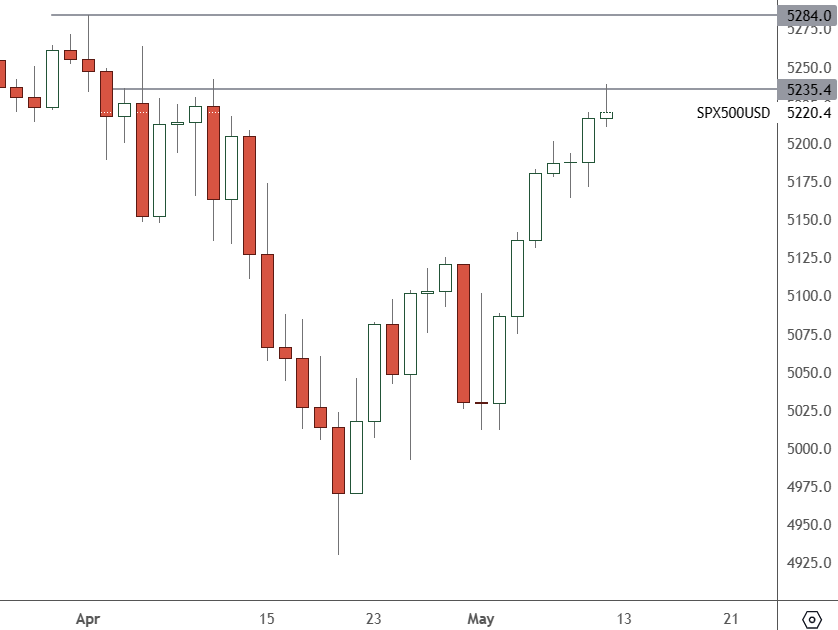

SPX 500 – Daily Chart

The S&P 500 found resistance at the 5,220 level and may start a correction. A push above this level could then test the all-time high.

The US stock market has struggled with hawkish comments from Federal Reserve officials on interest rates. Markets are hoping for a September start to rate cuts, but there is the potential for a delay.

In recent speeches and interviews, various Fed officials have added to the message that policymakers will take a careful, measured approach to monetary policy after recent inflation data.

New York Fed president John Williams said, “policy is in a very good place now.” In contrast, Minneapolis Fed president Neel Kashkari added, “I think it’s much more likely we would just sit here for longer than we expect.”

There were also comments from Chicago Fed president Austan Goolsbee on Friday, who said that the bank should wait before taking action.

The following essential data set will be the Consumer Price Index on Wednesday this week.

“They might need several months of inflation showing it’s coming back down before they’ll signal that … they have confidence to cut,” said Esther George, former president of the Kansas City Fed.

She added that there is still potential for two rate cuts this year, which is now priced into the market. Another former official said December was more likely for a first move on rates.

The Fed Chair Jerome Powell will give a speech on Tuesday evening, which may lead to a quiet market with no data.

Last week, Goldman Sachs noted that their buyback desk was set to see around $5.5 billion in stock buying this month and will continue to support the S&P 500.

Earnings season is winding down, and stock moves will likely become more focused on company-specific news or geopolitics.