Japanese inflation data will be released on Friday, and it could test the recent bounce in Nikkei stocks.

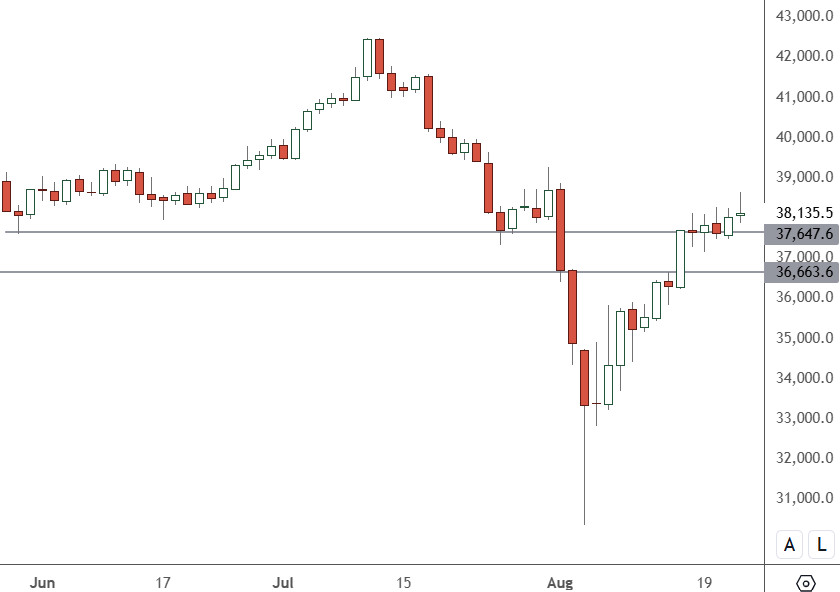

JPN225 – Daily Chart

The price of the JPN225 has bounced from the low in early August and is trading just above support. Inflation data and weakness in the US indices on Thursday may bring sellers.

Inflation data was released at 7:30 am HKT, and traders were looking at last month’s 2.8% rate.

Recent comments from Japanese policymakers have hinted at further rate hikes. They could hurt the Nikkei if traders see additional rate hikes coming. A higher-than-expected inflation number would put pressure on policymakers to act.

A recent reading of wholesale inflation released last week showed the fastest year-on-year pace in 11 months. A weaker yen pushed commodity import prices higher for the economy.

According to data from the Bank of Japan, the corporate goods price index (CGPI) highlights the price companies charge each other for goods and services, which climbed 3% in July from a year ago. An economist survey showed that 57% expect the Bank of Japan to raise rates again this year.

“The current policy rate is extremely accommodative,” said Atsushi Takeda, chief economist at Itochu Research. “The BOJ will continue to raise interest rates toward the neutral rate as long as the 2% price stability target is expected to be achieved”.

In July, the BOJ surprised many market participants by raising borrowing costs to 0.25% from 0%-0.1%. Governor Kazuo Ueda’s comments signalled the potential for further rate hikes in coming years. That led to a surge in the yen and a collapse in the Nikkei index.

“It is too early to assume that the market turmoil after the July additional rate hike has changed the path the BOJ envisions for rate hikes,” Kazutaka Maeda at Meiji Yasuda Research said.

That outlook could be determined by the coming inflation figures and continued strength in the Japanese economy. Japan’s economy grew by a much faster-than-expected 3.1% annual rate in the second quarter, recovering from a slump at the start of the year after consumption increased.

In the short term, Thursday’s sell-off in US stocks could hurt Asian stocks on Friday. Investors will then look ahead to Nvidia’s earnings release next week.