The GBPAUD exchange rate has continued to weaken from the August highs and is probing some key support levels.

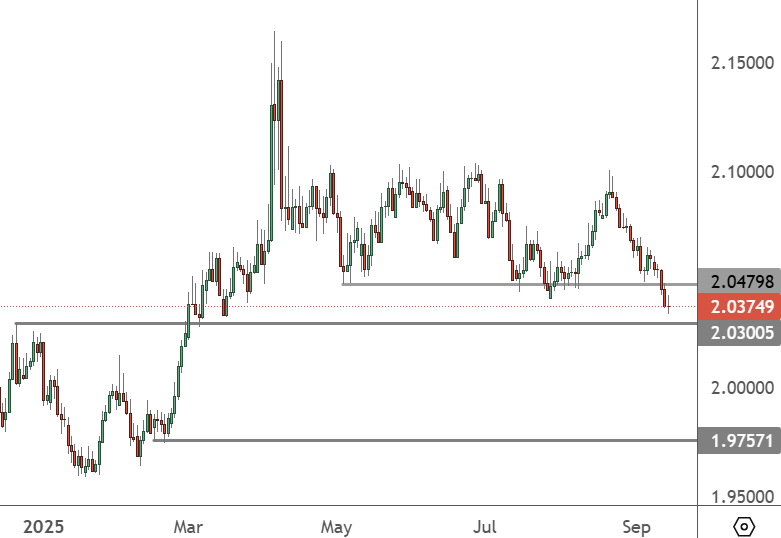

GBPAUD – Daily Chart

The GBPAUD has breached the 2.0480 level and the 2.0300 level is a key barrier. A move below there has little support until 1.9750.

The UK and Australian economies have both had their issues but the recent downturn in the UK has give strength to the Aussie dollar. Last week’s news that the British economy delivered zero growth in the previous quarter is another headache for the UK government.

The UK economy stalled in July, following a 0.4% rebound in June, according to Office for National Statistics (ONS). Further data from the UK showed monthly Industrial and Manufacturing Production both dropping by 0.9% and 1.3 in July. Both readings were lower than analysts had projected.

Finance minister Rachel Reeves said that the economy “isn’t broken, but it does feel stuck”.

“July’s slowdown is probably the start of a more restrained period for the economy with higher inflation and rising job losses likely to have stifled activity in August, despite an expected uplift from the warm weather,” said Suren Thiru ICAEW.

The Australian dollar has benefited from the UK’s struggles, but data is still weak in the Aussie economy.

Australian consumer sentiment dipped from the 3 year highs in September as concerns about the economy hit consumers. A Westpac-Melbourne Institute survey showed that the consumer sentiment index fell 3.1 per cent to 95.4, following a 5.7% August move to the highest since early 2022.

“Outright optimism remains elusive for Australian consumers,” said Matthew Hassan at Westpac bank. “The cost-of-living crisis may be largely over and policy easing generating some uplift but there is still clearly some unease about the path ahead”.

The Reserve Bank of Australia and Bank of England have completed their rate cycles for the moment. With the current bearish sentiment in place, the Australian dollar has the upper hand and traders can look for that extended move lower if buying support doesn’t emerge.