The US dollar slipped lower in early European trade Monday, trading near two-month lows ahead of the release of crucial US inflation data for more clues over the timing of the start of the anticipated Federal Reserve rate-cutting cycle.

At 04:30 ET (09:30 GMT), the Dollar Index, which tracks the greenback against a basket of six other currencies, traded 0.1% lower at 102.287. It had registered a hefty weekly loss of over 1% last week and fell to levels last seen in mid-January.

The dollar is still weak ahead of the US CPI.

The dollar was hit hard last week after Fed chief Jerome Powell’s comments during his two-day testimony in front of Congress were seen as dovish by the markets, suggesting the US central bank was preparing to start cutting interest rates in the summer.

Mixed jobs data on Friday–with nonfarm payrolls increasing by 275,000 but the unemployment rate rising to 3.9% in February after holding at 3.7% for three straight months–kept an anticipated June Fed interest rate cut on the table.

Now, traders will examine Tuesday’s US inflation data to gauge how soon the Fed could start cutting interest rates.

Economists expect February’s consumer price index to rise 0.4% after a faster-than-expected increase of 0.3% in January.

ING analysts wrote in a note, “We expect inflation figures to stop the dollar decline this week.”

“The shifts in FX positioning last week no longer justify an exacerbation in USD downward pressure unless key data starts to turn in favour of Fed easing. There is a non-negligible risk that part of the USD losses driven by Powell’s testimony are unwound this week.”

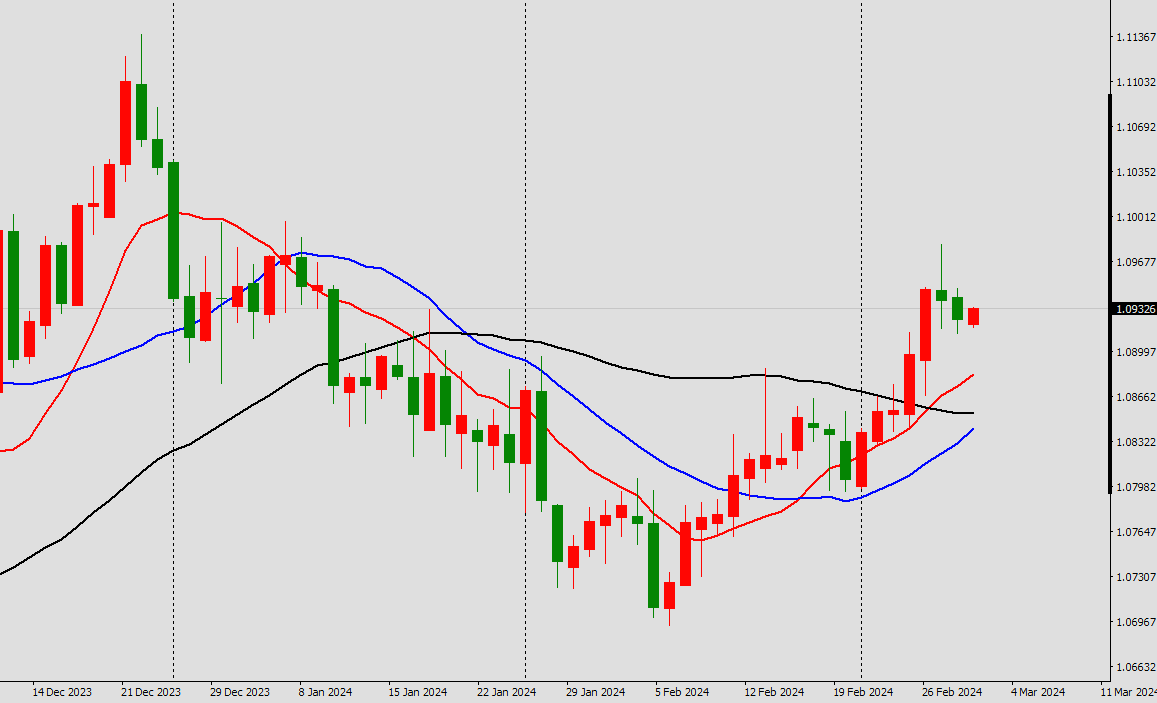

Euro near eight-week high

EURUSD Daily Chart

In Europe, EUR/USD edged 0.1% higher to 1.0944, with the euro retaining strength after hitting an eight-week high against the dollar last week. The euro recorded its best weekly performance against the buck since the week ended Dec. 22.

The ECB kept rates at record highs of 4% last week while hinting that June could be the month to start cutting interest rates to support the region’s stuttering economy.

Traders will also look to the January industrial production print for the eurozone, due later in the week.

December’s report showed a significant increase in production, which erased a full year of declines. Another strong reading would be an encouraging sign for first-quarter GDP growth.

“We see some downside risks this week for EUR/USD, and a correction could take it back to the 1.0850-1.090 area,” said ING.

“However, our call for a first rate cut in June by both the ECB and the Fed can still argue for a higher EUR/USD, as the Fed should ultimately deliver a larger easing package.”

GBP/USD traded 0.1% lower at 1.2841 ahead of Tuesday’s latest UK jobs report. Traders and the Bank of England focused on wage growth amid speculation over the timing of a first-rate cut.

Yen in demand ahead of BOJ meeting

In Asia, USD/JPY traded 0.3% lower to 146.70, with the yen surging sharply in the past two sessions to an over one-month high. This was supported by a growing conviction that the Bank of Japan was close to ending its ultra-easy monetary policy.

An upward revision in GDP data showed the Japanese economy dodging a technical recession in the fourth quarter, giving the BOJ more headroom to tighten policy sooner, potentially as soon as next week’s meeting.

USD/CNY edged lower to 7.1840, while AUD/USD fell 0.2% to 0.6614 amid waning bets over more rate hikes by the Reserve Bank of Australia.