According to the latest data from the Hang Seng Indexes (HSI), Chinese investors continue to hold a significant sway over the trade in Hong Kong stocks. This trend is crucial for our understanding of the current market dynamics.

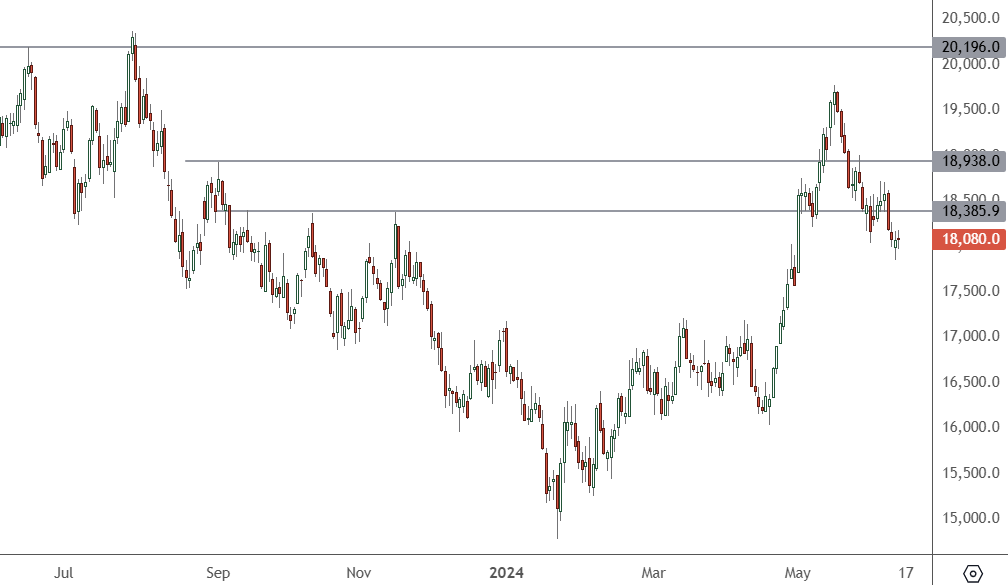

HK 50 – Daily Chart

The HK 50 index spiked above resistance at the 18,938 level but has since slumped back and trades below a lower resistance at 18,385. These are the two markers if the price wants to return to the psychological 20,000 mark.

One of the most intriguing developments is the doubling of southbound inflows under the Stock Connect scheme in 2024, reaching a staggering $321 billion, a figure that piques our curiosity about the potential future market trends.

“The strong rally, which began in late January, came amid strong inflows from southbound investors,” HSI said. “Notably, if the monthly net inflows remained positive by the end of June, it would mark the 12th consecutive month of positive net inflows for southbound investment.”

Financials were the favourite sector, with 31%, followed by technology stocks at 22% and energy at 18%. The energy sector also saw its most considerable weighting increase, up from 13% last year.

Chinese stocks may have seen their rally relaxed off, but billionaire US investor David Tepper is still a fan. Through his Appaloosa Management hedge fund, Tepper increased his stake in online retailer PDD Holdings by almost 171%. The billionaire investor also increased his Baidu stake by 188%, adding a new position in JD.com.

However, Tepper’s most significant investment came in Alibaba Group, where he bought 6.9 new shares in Q1. The company is now his largest holding, worth $814 million.

Support from US value investors could continue as US stocks press all-time highs, and mainland China support will likely build over time.