Gold ETFs finally saw investors return after 12 months of outflows as prices hit new record highs.

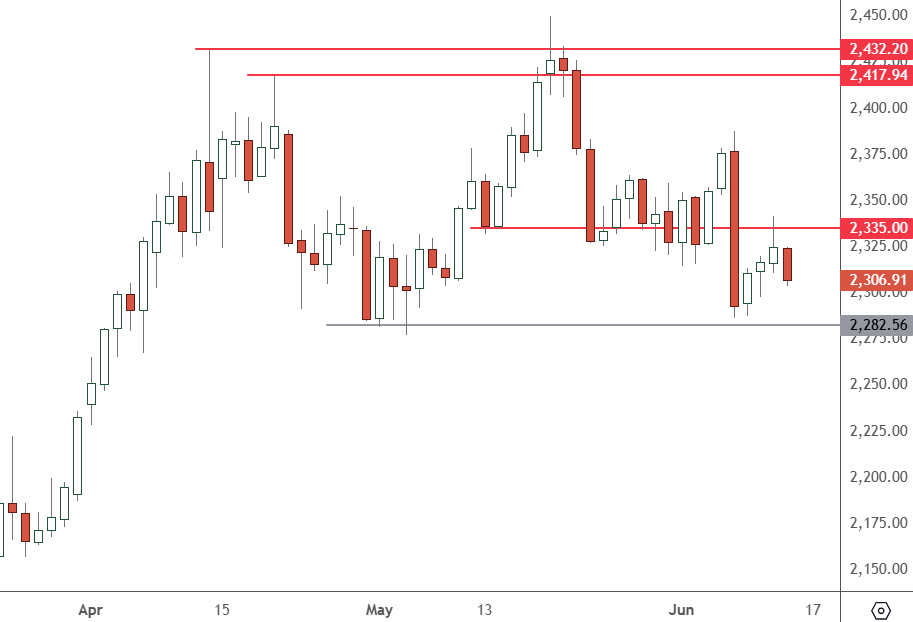

GOLD – Daily Chart

Gold prices saw a bounce fade out at the $2,235 level and may look to test the $2,282 support level. If that level breaks, then the move lower could be swift.

According to the World Gold Council’s latest monthly report, physically backed gold exchange-traded funds saw their first monthly inflow in a year, amounting to $529 million. Strength in the price of the precious metals and inflows pushed gold ETF’s assets under management (AUM) to US$234 billion, up 2%.

Flows were different between the United States and Europe/Asia in May. Gold flows in North America returned to negative in May at -$139 million following two consecutive monthly inflows. However, compared to the region’s outflows in prior months, the negative print in May was the smallest since December 2019. Total outflows in North America for the year in North America reached $4.3 billion. This was second only to Europe, driven by large fund selling in January and February.

European inflows in May were $287 million, ending a twelve-month losing streak. Asia recorded the 15th consecutive monthly inflow, with an additional $398 million in May. However, that was the region’s most minor inflow since November 2023. China was once again the driver in the area, with $253 million in demand.

Asia is the only region with inflows for 2024, with $2.6 billion. Gold surged in May as investors turned to safe-haven assets with tensions in the Middle East. A slow move toward a ceasefire has taken some demand out of the price of bullion.

Markets were also expecting an early rate cut from the US central bank in June, but that has been pushed back to September as soon as possible. This week’s favourable inflation data has slightly turned the tables, but gold is not benefiting from that change.

“Powell acknowledging that the FOMC had a chance to change projections after seeing today’s data and his emphasis that it’s ONE good report sends a clear message: ‘Don’t send out the Pivot Party invitations just yet,” said Tai Wong, a New York-based metals trader.

“Gold will continue to trade with employment and inflation data.”