GBPUSD was lower on Tuesday after weaker-than-expected jobs data.

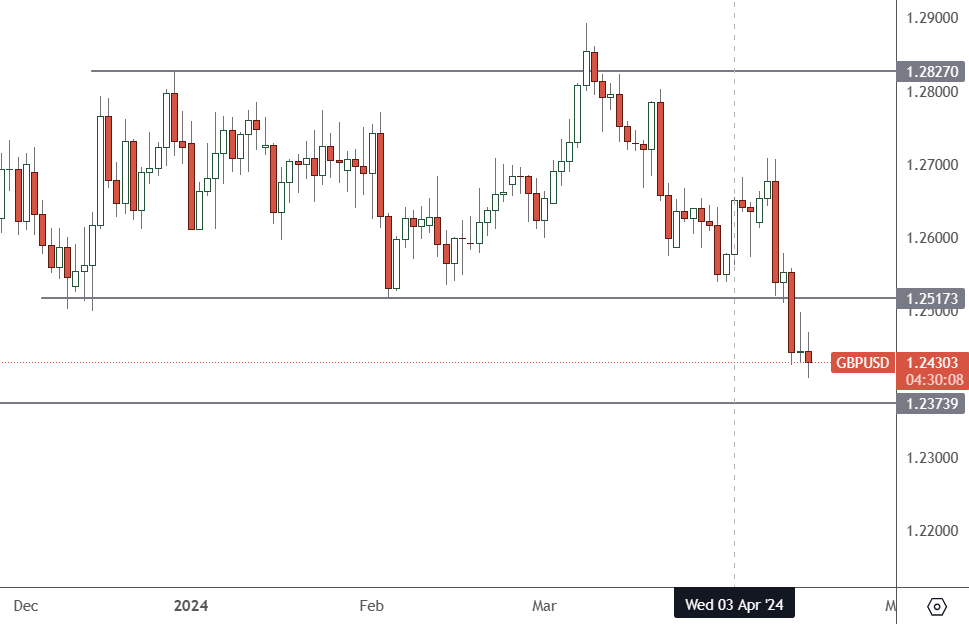

GBPUSD – Daily Chart

GBPUSD has lost some serious ground since last week and could see a test of support at the 1.2373 level soon.

The UK witnessed an alarming unemployment surge, surpassing City economists’ expectations. This unexpected rise has raised concerns about employers resorting to staff cuts in response to higher interest rates. The Office for National Statistics reported a sharp increase in the unemployment rate to 4.2% in February from 3.9%, a figure significantly higher than the anticipated 4%.

The UK is bracing for Wednesday’s release of inflation numbers. This crucial event could further weaken the pound, especially after Federal Reserve comments.

Hawkish Fed comments pushed bond yields higher on Tuesday and weighed on stocks. Fed Vice Chair Jefferson said, “If incoming data suggest that inflation is more persistent than I currently expect it to be, it will be appropriate to hold in place the current restrictive stance of policy for longer.” That came after San Francisco Fed President Daly said on Monday that there’s “no urgency” for the Fed to adjust interest rates. She said, “The labour market’s not giving us any indication it’s faltering, and inflation is still above our target, and we need to be confident it is on a path to come down to our target before we would feel the need to react.”

With markets now looking at higher rates for longer in the US, the UK is getting its inflation numbers down. However, deflationary trends and a weaker economy and job market could help.

The UK inflation release will come at 2pm HKT. If the number is weaker, the British pound could experience some volatility. Markets are now doubting the pace of US rate cuts, but weakness in the UK jobs market could see central bankers move on their benchmark rate.