Thursday’s economic data will test the recent pullback in the GBPAUD exchange rate.

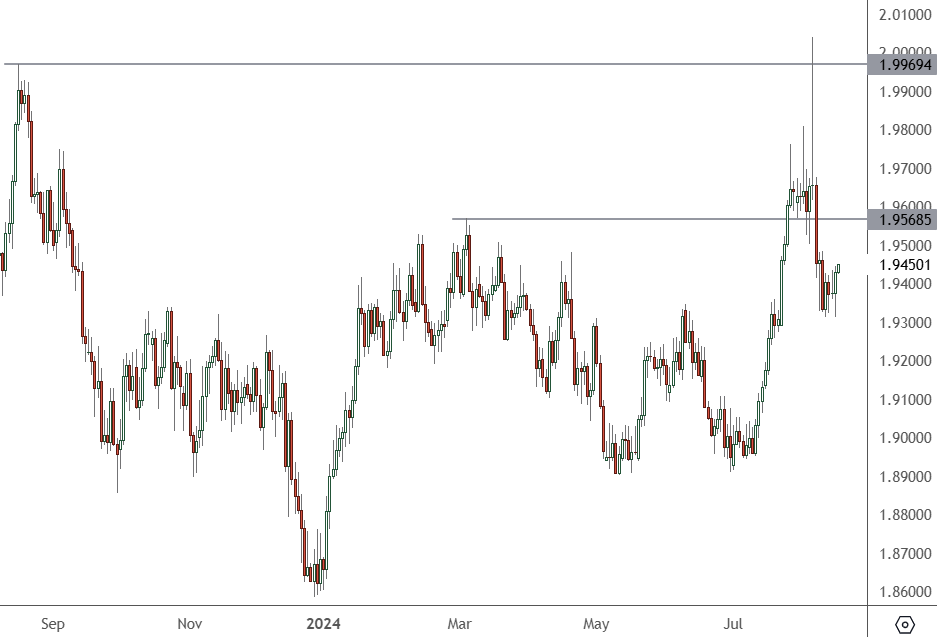

GBPAUD – Daily Chart

The GBP v AUD recently surged to the 2.000 level and was rejected. A bounce is in play toward resistance at 1.9600 but could continue on the correction trend.

The first data set on Thursday is at 9:30 am HKT with Australian employment data. The country added 50.2k jobs last month, and analysts now expect 20k.

The unemployment rate has been grinding higher over the last 12 months. In June 2023, it was 3.5%, but a year later, it was 4.1%. The Reserve Bank also expects that figure to keep rising from here, with a forecast of 4.3% by the end of the year and 4.4% by June next year.

The Australian Bureau of Statistics will also release new data on average weekly earnings and overseas arrivals and departures. The RBA has held its monetary policy steady since November. The bank sees the current cash rate of 4.35% as restrictive enough to bring inflation down while preserving employment gains.

That will be followed at 2 pm HKT by the latest United Kingdom growth figures.

The second quarter preliminary figure is expected to jump from 0.3% to 0.9%. However, annual data is expected to be 0.8% from 1.4%.

Inflation data on Wednesday has helped the case for further rate cuts in the UK, with a smaller rise in monthly inflation figures. Analysts had been expecting a price rise from 2% to 2.3%, which could force a pause from the Bank of England.

However, the 2.2% figure was less than expected and will not cause alarm at the central bank.

According to economists, the European Central Bank is expected to cut its benchmark rate once each quarter through the end of next year. The economy also saw inflation rise to 2.6%, but economists expect further rate cuts this year.