The EURGBP exchange rate has central bank action ahead on Wednesday as the pair trades at a key support level.

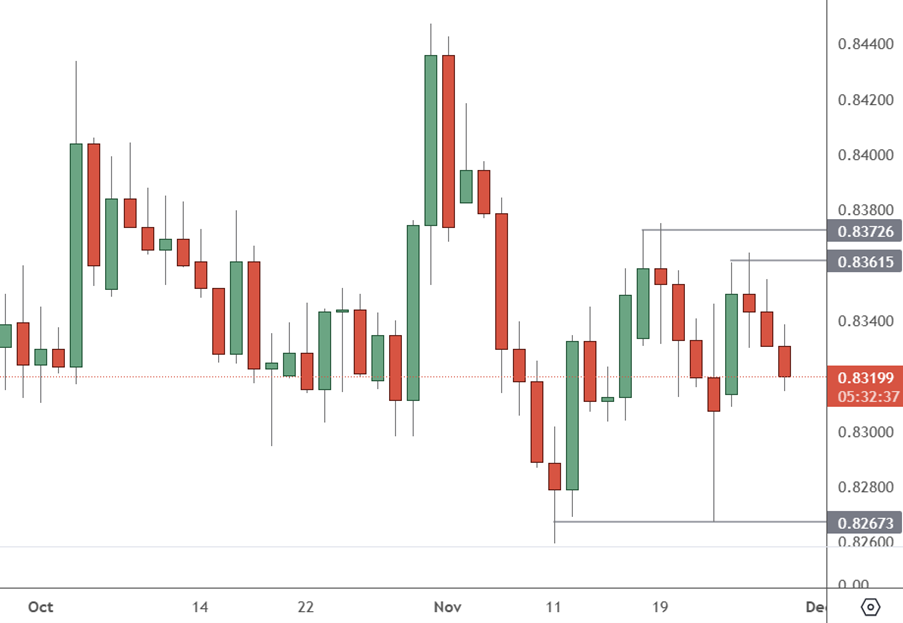

EURGBP – Daily Chart

The price of EURGBP has been on a three day downtrend and is looking toward the 0.8267 support. The trend may be more pronounced but GBP weakness is an issue due to government taxes and policy.

French President Emmanuel Macron is fighting against a political and economic crisis as Paris’ borrowing costs briefly exceeded Greece’s for the first time on Wednesday. Greece was at the centre of the European debt crisis in 2010, so the development is embarrassing for France.

In the bond market, where issued debt is traded, Greek bonds were priced at 3.02%, while French bonds rose to 3.05%. The economic woes are being driven by Prime Minister Michel Barnier’s struggles to gain support for the 2025 budget. He wants to cut spending and raise taxes to try and tackle the country’s deficit.

France’s problems are deep and the attempts to stimulate the economy have added to the problem. The country’s budget deficit is now 6% of GDP, while its debt-to-GDP ratio has surged to 112%, up from 95% in 2015. Last year, Macron faced widespread protests over his decision to raise the retirement age from 62 to 64. European Central Bank President Christine Lagarde recently warned that France’s fiscal trajectory is unsustainable without major reforms.

The recent activity has hit the euro against global currencies and may have caused more damage against the British pound if the UK did not have its own struggles. Keir Starmer’s government has only been in power four months but has faced protests from farmers, backlash from business and a petition from 2 million citizens calling for another election.

Many believe the government has backtracked on its manifesto to avoid raising taxes. Budget airline Ryanair was the latest to protest, saying that they will reduce the number of domestic flights due to the Labour Party’s tax raid.

The economic calendar is busy on Friday for the UK and Europe around 3pm HKT. British house prices and numbers on mortgages and credit will be released. Germany will release unemployment figures, alongside European consumer price inflation.

The German employment picture is worsening as the auto industry makes job cuts. Slow demand for electric vehicles and lower Chinese exports has hurt the former European powerhouse.

The EURGBP exchange rate is a tale of two troubled economies and volatility is likely to persist.