There have been hot debates amongst traders over which is the better asset to trade between stocks and indices. The common belief is that Indices remains the more tradeable asset as it combines a group of stocks, making them more volatile. Thus one can easily speculate and predict the direction of a group of stock over extended periods. On the other hand, some stock enthusiasts believe that trading a single stock rather than a group of stocks could be more precise in determining market movement. Well, every trader has got their favourite assets, but what are some exciting facts about Indices?

Why do some prefer Indices?

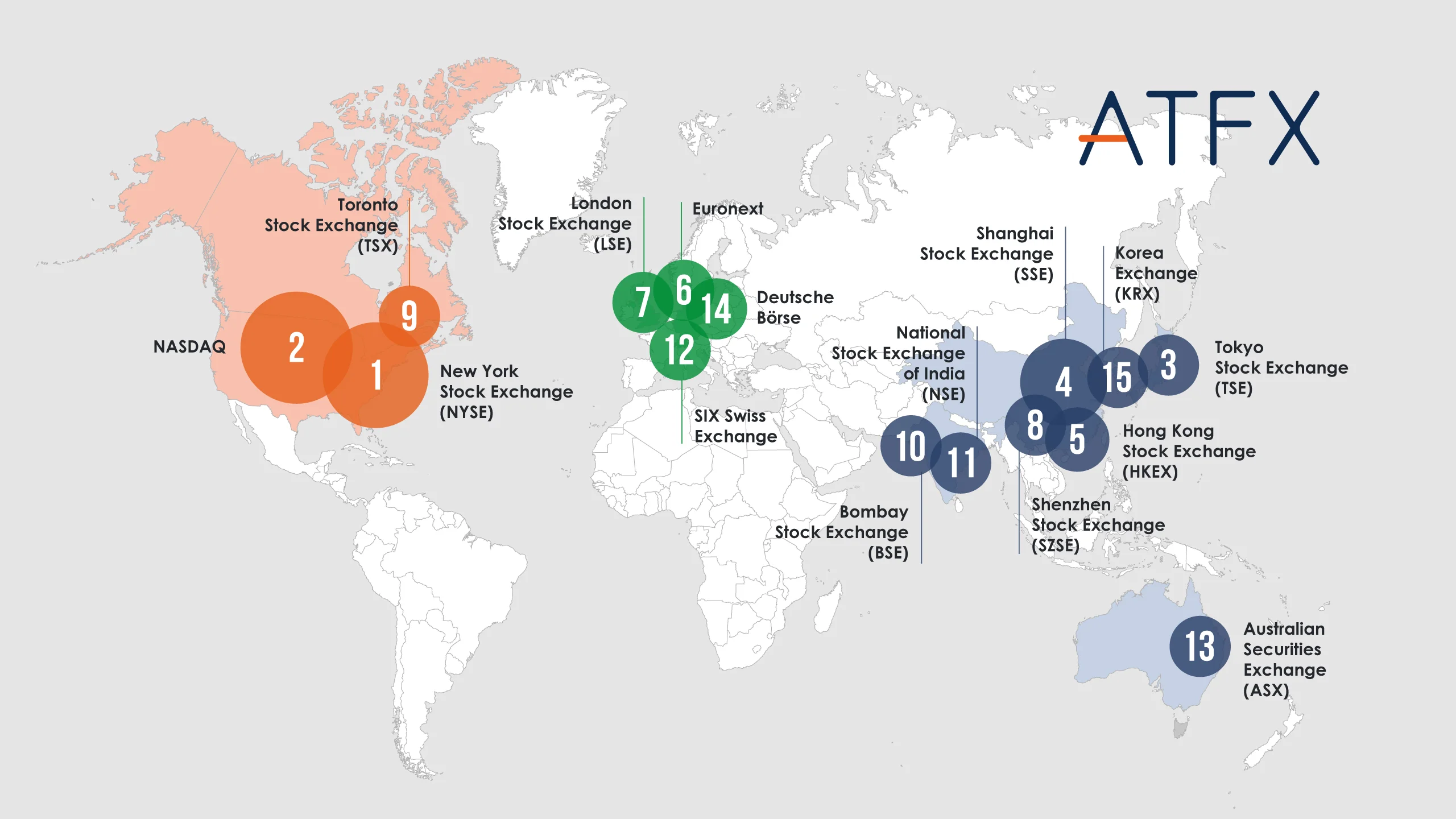

Indices measure the price performance of a group of stocks from an exchange. For example, the FTSE 100 tracks the 100 largest companies on the London Stock Exchange. Trading indices undoubtedly enable you to get exposure to an entire economy or sector at once while only opening a single position. They are highly liquid, which gives traders tight spreads and clear chart patterns. Moreover, the Index market is considered more volatile and significant simply because it represents economic health. Indices allow traders to bet on the index price going up and down. This leads to more opportunities as traders can capture the upside and downside of a movement.

Most traded Indices today

- DJIA (Wall street) – measures the value of the 30 largest blue-chip stocks in the US

- Dow Jones – measures the daily price movements of 30 large American companies on the Nasdaq and the New York Stock Exchange. The DJIA is price-weighted, which means stocks with higher share prices are given greater weight in the index.

- DAX (Germany 40) – tracks the performance of the 40 largest companies listed on the Frankfurt Stock Exchange

- S&P Global 200 index – A benchmark institutional investable stock market index in Australia, comprising the 200 largest stocks.

- Cannabis Stock Index- BGCANG follows the Cannabis Industry’s top performers.

- VIX Volatility Index – Based on CBDOE’s ‘fear gauge’, this index follows S&P 500 futures contracts to predict volatility and trader confidence.

- Crypto 10 – Follows and measures the performance of the top 10 cryptocurrencies in the market, including Bitcoin, Ethereum & more, as reported by BITA Data.

- NASDAQ 100 (US Tech 100) – reports the market value of the 100 largest non-financial companies in the US

- FTSE 100 – measures the performance of 100 blue-chip companies listed on the London Stock Exchange

- S&P 500 (US 500) – tracks the value of 500 large-cap companies in the US

Interesting Facts about Stocks

Some investors prefer stock trading alone due to lower risk exposure, and consistent practice can lead to quick mastering of the stock price movements over a given period. Owning stocks in different companies can help you build your savings, protect your money from inflation, manage taxes and maximize income from your investments.

Most Popular stocks to trade today

The following is a list of the most popular stocks in the market today.

- Intuitive Surgical, Inc. (NASDAQ: ISRG)

- Coinbase Global, Inc. (NASDAQ: COIN)

- Twilio Inc. (NYSE: TWLO)

- Shopify Inc. (NYSE: SHOP)

- DigitalOcean Holdings, Inc. (NYSE: DOCN)

- Advanced Micro Devices, Inc. (NASDAQ: AMD)

- Upstart Holdings, Inc. (NASDAQ: UPST)

- Target Corporation (NYSE: TGT)