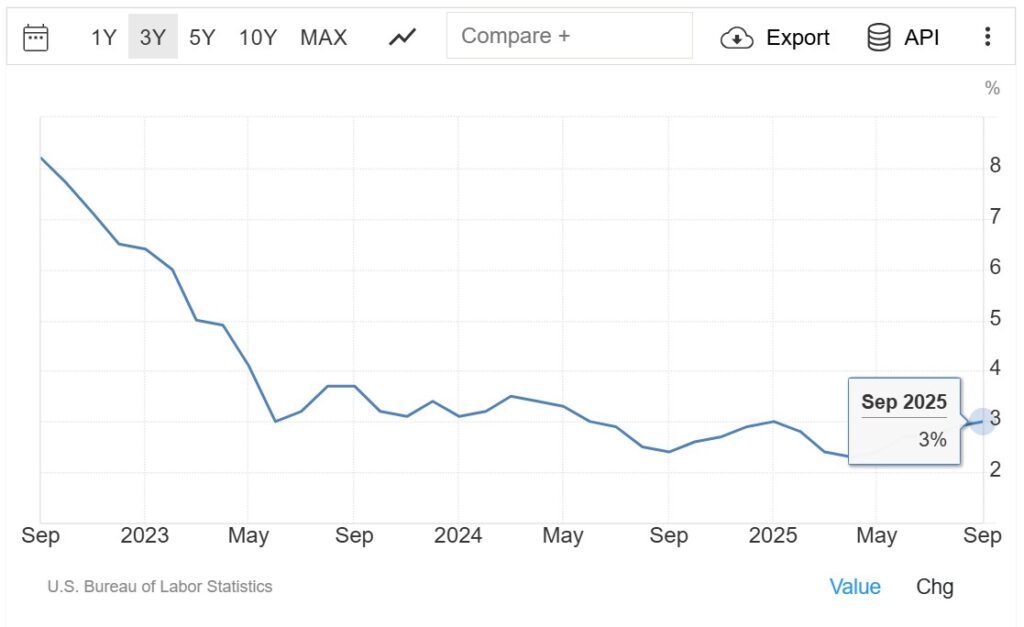

The upcoming U.S. Consumer Price Index (CPI) report due on November 13, 2025, at 08:30 ET could be the final major catalyst for markets this year. With inflation edging back toward 3% and traders watching closely ahead of the Federal Reserve’s December 10 meeting, the data will help determine whether the easing cycle continues or gets pushed into 2026. Recent months have shown uneven progress as energy prices rebounded, shelter costs stayed sticky, and wage growth slowed, leaving markets eager for clarity on where inflation stands.

The chart below tracks U.S. headline and core CPI over the past three years, showing how inflation cooled through 2024 but rose again to 3.0% in September 2025 amid higher energy and shelter costs.

Source: TradingEconomics.com (U.S. Bureau of Labor Statistics)

Why Traders Should Care

The previous CPI report triggered sharp swings in the U.S. dollar, bond yields, and equity indices. With traders debating whether the Fed will hold rates steady or signal a cut in December, this November report carries even more weight.

A stronger reading could lead to a market price in a longer period of tight monetary policy, boosting the U.S. dollar while pressuring stocks and Treasuries. A softer print could reinforce the view of easing inflation and open the door for policy loosening in 2026.

Persistent price pressures in shelter and services have kept inflation above target, while a sharper slowdown could encourage policymakers to begin easing next year.

What to Watch in the CPI Report

This month’s release will show whether inflation is finally cooling or starting to heat up again after a brief rebound.

Here are the main areas traders will be watching closely:

- Headline inflation (MoM & YoY): Measures overall price changes, including food and energy, offering a broad snapshot of cost pressures.

- Core inflation (MoM & YoY): Excludes food and energy to highlight underlying price trends that guide monetary policy.

- Revisions to past data: Even minor updates can shift how investors interpret the broader inflation path.

- Sector focus: Shelter, energy, and services remain the key drivers shaping the Federal Reserve’s inflation outlook.

Core services inflation, particularly in housing and healthcare, remains elevated, while goods inflation has eased due to stable supply chains and softer demand. Bloomberg and Reuters project similar results to September’s +0.3% headline and +0.2% core readings, but any surprise could trigger sharp volatility.

Market Reactions: What to Expect

If inflation runs higher than expected, the U.S. dollar may strengthen as traders price in prolonged tightening, while stocks and bonds could face pressure.

A softer reading may weaken the dollar, lift equities, and support gold on hopes of an earlier policy shift. If results are mixed, markets will likely focus on core inflation as the Fed views it as a clearer signal of persistent price pressures.

Treasury yields often react first, sometimes moving 10 to 20 basis points within hours, setting the tone for equity and forex markets.

Trading Ideas to Consider

- Watch U.S. Treasuries: Yields usually move first when CPI surprises, influencing equities and major currencies.

- Focus on key currency pairs:

- USD/JPY is sensitive to shifts in yield spreads and Fed expectations.

- EUR/USD often moves inversely to U.S. inflation surprises.

- Monitor Gold: Often strengthens when inflation eases or the Fed turns more dovish.

Given the likelihood of fast market reactions, traders should prioritize liquidity and spreads around the data release rather than aggressive directional positions. Managing exposure during the first few minutes can be as important as the trade itself.

Managing Risk and Reaction

Volatility typically peaks right after the release. Expect wider spreads, rapid price swings, and potential slippage. Many traders reduce position size or use limit orders to control execution risk. Watching how Treasuries and USD pairs react in the first hour often provides clues to short-term direction.

It is also worth tracking shifts in CME FedWatch probabilities, as these reveal how traders interpret the CPI outcome ahead of the Fed’s December meeting.

Beyond November, this CPI release will remain key for traders assessing how quickly inflation might return to the 2% goal.

- It will set the tone for the December FOMC meeting, where policy guidance for 2026 may emerge.

- It will help determine whether inflation can drop below 3% or if persistent services inflation keeps rates higher for longer.

- It will likely influence rate expectations, portfolio positioning, and year-end market sentiment.

The data may also shape early 2026 market dynamics, showing whether investors expect a smooth soft landing or renewed inflation risks.

Looking Ahead Next CPI

The next CPI report on November 13 is more than just another data release; it could mark a turning point for global markets. Stay alert, manage exposure carefully, and watch how inflation data reshape expectations for U.S. monetary policy heading into 2026.

Even after the dust settles, this CPI report will remain a key reference point for investors, policymakers, and traders monitoring the path of inflation into the new year.