A two-day drop in Nvidia has hurt the semiconductor market, which has pushed the market higher recently.

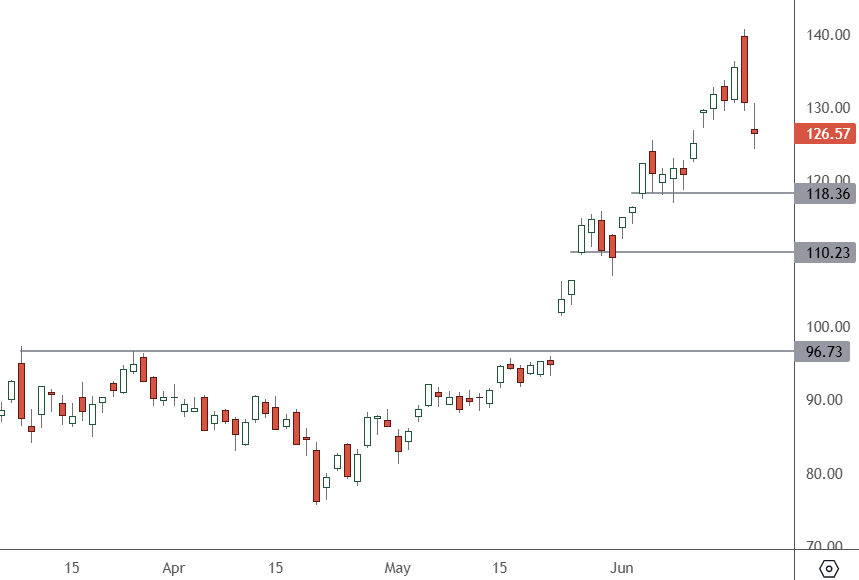

NVDA – Daily Chart

With the price of NVDA currently at $126.57, investors are on high alert for the possibility of a more substantial correction. It’s crucial to note that support is expected to come in at previous gaps around $110 and $118.

Last week, Nvidia surged to a $3.3 trillion market valuation and briefly held the world’s most valuable company title. However, the correction saw it slip back below Microsoft and Apple.

There was no news catalyst for the Nvidia selloff, highlighting investors’ jitters about the continued bull run that has seen the stock gain 200% over the last year.

The price drop also showed the broader market’s reliance on Nvidia. The S&P 500, which had gained 0.3% in the morning, lost 0.6% by the afternoon, with almost all of the fall explained by the chipmaker. Friday saw other chip stocks lower, with Micron and Broadcom losing ground.

Investors will be watching the stock closely this week. Any further correction could lead to profit-taking from large investors. Nvidia is an essential stock for tech ETF and hedge fund managers. Recent data also said that the long AI bet was the most crowded trade among professional investors, and any bump in the road could be volatile for the market.