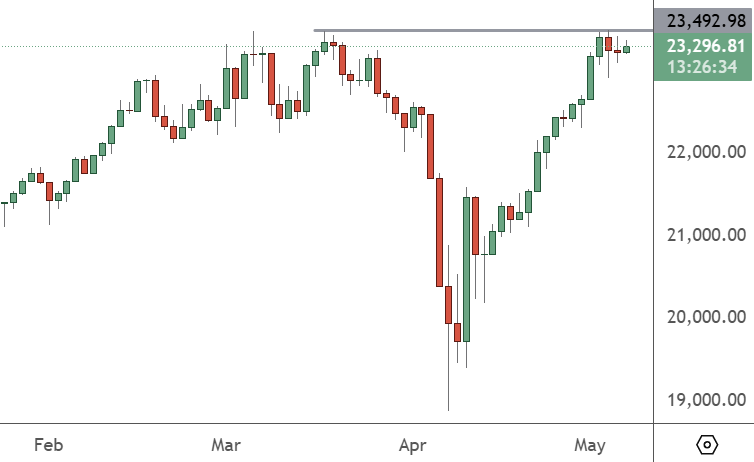

The German stock index (GER30) has shrugged off some election drama to hover near its all-time highs.

Some mild selling created a barrier at the previous highs but there is still room to rally through that level and aim to create further upside.

Friedrich Merz’s failure to secure a Bundestag majority sent shockwaves through German markets on Tuesday, raising questions about the country’s political stability as economic clouds darken.

“His setback adds fresh uncertainty to Germany’s export-driven economy, which is already under pressure from shifting US trade policies,” said Welt’s Holger Zschäpitz.

“Germany voted for change. Politicians decided to keep everything unchanged. Now, the coalition of industry and economic destruction cannot even agree to vote for a chancellor,” said Daniel Lacalle, chief economist at Tressis.

Merz, the leader of the conservative CDU/CSU bloc, believed he had secured a post-election coalition agreement with the Social Democrats. But with a stunning reversal, he received just 310 of the 316 votes needed to officially become chancellor. It is the first time in postwar Germany that a presumptive chancellor has failed to gain parliamentary approval after such a deal.

In a second vote, Merz did get the required approval but it raises questions about the ability to push through reforms. Investors will focus on Merz’s plans to revive Germany’s flagging economy. Despite economic weakness, stocks remain elevated and will need to see positive data to hold onto the current gains.