The EURJPY exchange rate saw another price surge before crashing down, hinting that BOJ intervention may be in play.

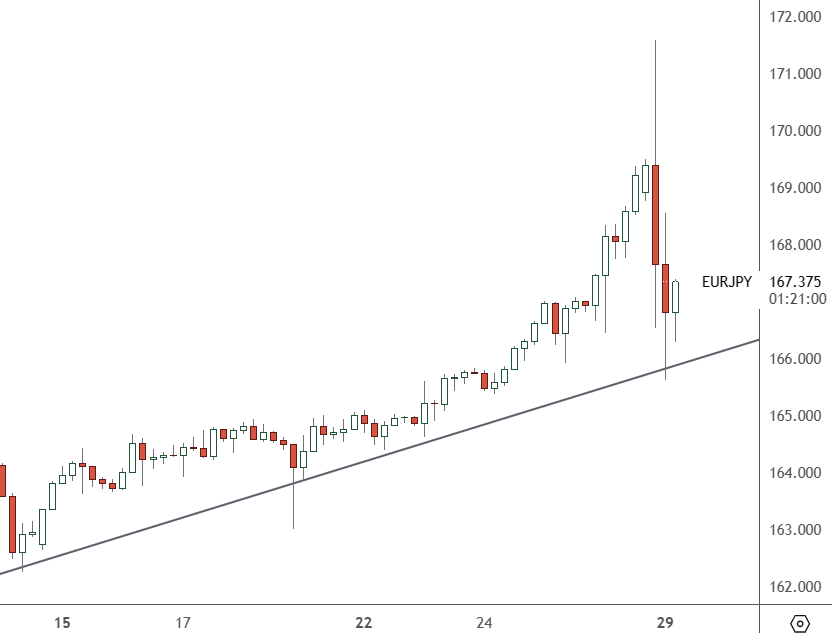

EURJPY – 4H Chart

The price of EURJPY surged above 171 but then dumped to around 165.50. Uptrend support is coming into play, and the long side could be risky.

The yen surged on Monday against a basket of currencies, with traders citing yen-buying intervention by Japanese authorities to protect the country’s currency, which had slumped to levels not seen since more than three decades ago.

Traders have discussed potential intervention for weeks, and the currency has fallen more than 10% this year against other global currencies. FX traders have continued to bet that Japanese rates will remain low for an extended time while other central banks keep their benchmark rates elevated.

Japan’s top currency diplomat, Masato Kanda, did not comment when asked if authorities had intervened but said the recent developments in the currency market were “speculative, rapid and abnormal”.

“Today’s move, if it represents intervention by the authorities, is unlikely to be a one-and-done move,” said Nicholas Chia at Standard Chartered Bank in Singapore.

The long side is a dangerous bet, as we saw the first hint of intervention from the Bank of Japan.

For traders seeking to play the volatility in the yen, there is a lot of economic data ahead on Tuesday for the euro. French intervention starts the data at 2:45 pm HKT. German unemployment data comes at 3:55 pm, followed by European core inflation data at 5:00 pm.

The yen’s level will be critical going into the start of the session. With the first signs of intervention, markets see that anything over 170 is unacceptable to the BOJ, and there is a risk of further comments from policymakers. The Bank of Japan is also constantly reminded that its monetary policy is too loose and may have to be changed at the next policy meeting.