Bitcoin tumbled more than 5% Wednesday, falling below $100,000 for the first time since May and extending a selloff that began after the crypto market’s so-called Black Friday in mid-October. The drop marks its steepest retreat since the token hit an all-time high above $126,000 earlier that month and caps its first losing October since 2018.

BTCUSD – 24 Hour Chart

Now the key question is whether this pullback signals the start of a deeper downturn, typical in crypto’s volatile cycles, or sets the stage for a buying opportunity.

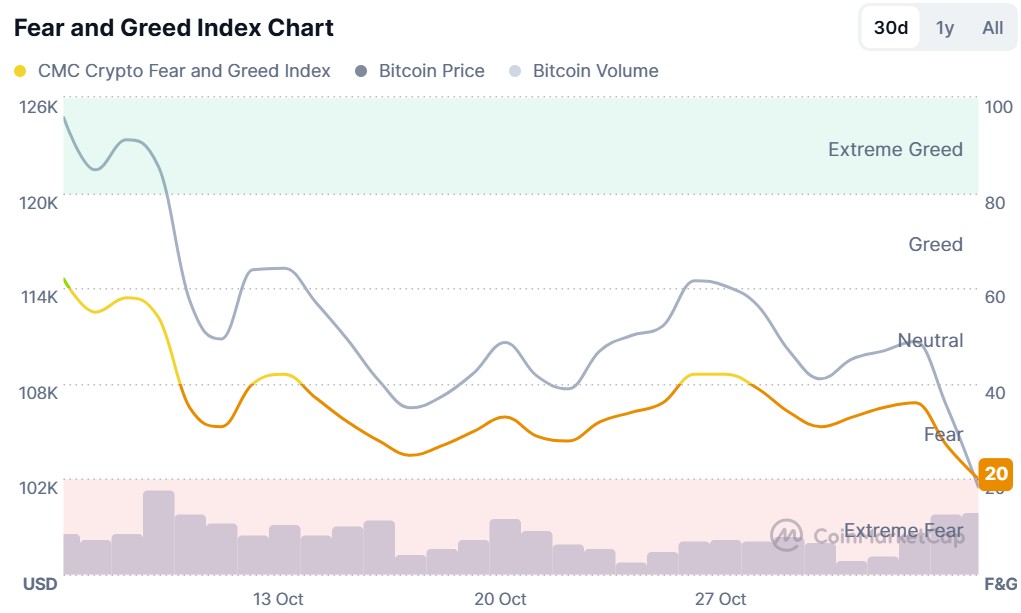

Market sentiment is turning cautious. The Crypto Fear & Greed Index shifted into “fear” territory Tuesday, down from “neutral” just a week earlier, according to CoinMarketCap, reflecting growing unease among traders.

Outflows from spot bitcoin ETFs are accelerating. BlackRock’s iShares Bitcoin Trust (IBIT), Fidelity’s Wise Origin Bitcoin Fund (FBTC), and Grayscale’s Bitcoin Trust (GBTC) have collectively seen about $1.3 billion in net outflows since October 29, data from SoSoValue show. Spot ether ETFs lost roughly $500 million over the same period.

Alternative cryptocurrencies fared even worse. Ether (ETHUSD) and Solana (SOLUSD) each dropped more than 8%. The selloff spilt into equities, with MicroStrategy (MSTR), Coinbase Global (COIN), and Robinhood (HOOD) all closing down at least 6%, and trading lower still in after-hours action.

Yet not all are pulling back. MicroStrategy, co-founded by bitcoin evangelist Michael Saylor, said Monday it purchased 397 bitcoins between October 27 and November 2 at an average price of $114,771, underscoring its continued conviction in the asset.