Chipmaker Intel (NAS100:INTC) has Q2 earnings ahead this week, analysts will look to see how the company’s turnaround is working.

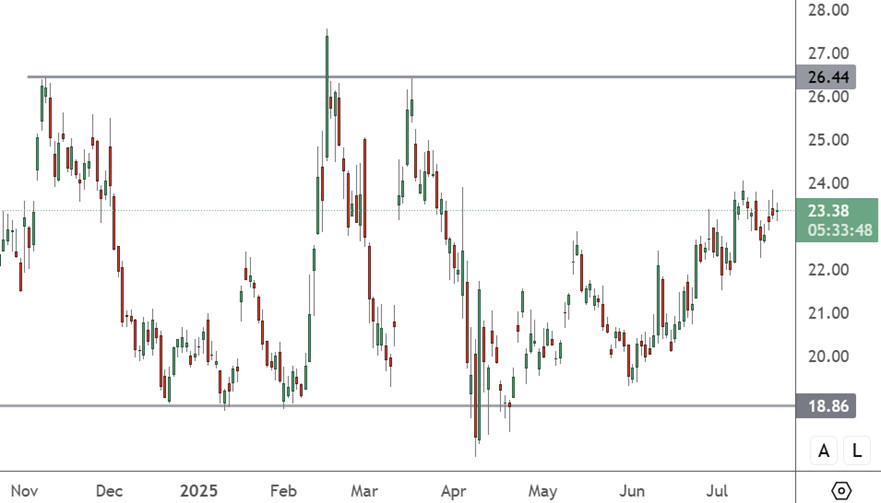

INTC – Daily Chart

INTC trades $23.38 and is in the middle of the range from $18.86 to $26.44.The recent activity is bullish and a surprise could head for the resistance level.

Intel is expected to report a bad quarter on Thursday and is not expected to be profitable as new CEO Lipu Tan starts the restructuring of the company. Intel is losing big market share to AMD and Nvidia and it could take some time for strength. However, AMD has started to see a strong performance as it adjusts its business model to target AI-driven revenue flows.

Earnings estimates for 2025 and 2026 have plunged at Intel compared to the last quarter. The majority of Wall Street analysts now view Intel as a hold or sell. The problem with Intel is that they are at an early stage of AI thoughts. Near-term guidance is weak and companies like TSMC and Nvidia are dominating the industry.

Analysts will be watching the earnings call to see if management has plans to close the gap on the AI leaders.