A surge in the Chinese yuan versus the US dollar could be a sign that a price low is forming.

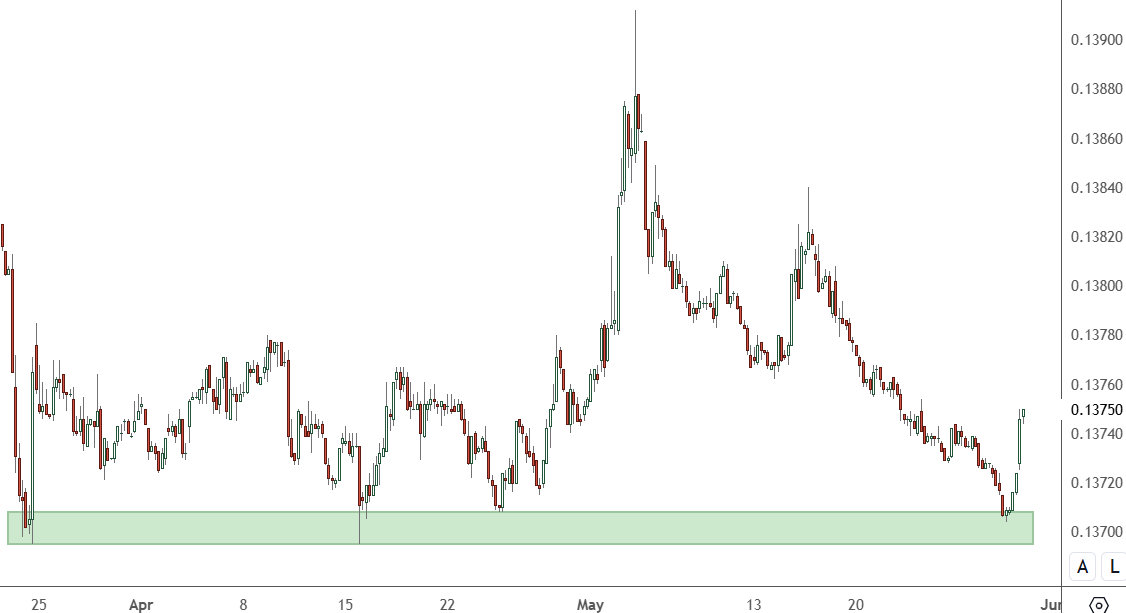

CNHUSD – Daily Chart

The CNH offshore rate tracks the CNY and aims to carve out a bottom against the USD. The support levels here return to the low in March, which should be strong.

Trading starts at 9:30 a.m. HKT with the release of China’s NBS manufacturing PMI data. Last month’s figure was 50.4, just above the 50 level, marking expansion or contraction. Analysts are looking for 50.5 this month, but a more substantial number could be like a rocket under the yuan.

China’s government has been hoping to challenge the hegemony of the US dollar. However, a survey by the Bank of Communications, China’s fifth-largest, said 47.7 percent of enterprises said the lack of interest among trading partners in using the yuan was the main hindrance to their performance. Despite that, the economic picture for government debt in the US may eventually force a rush to the yuan.

The Chinese authorities have helped the recent plunge in the yuan to boost exports, but they may be reaching a tipping point where investors see a bargain.

The PBOC has been trying to find the optimal level of yuan weakness to boost growth without triggering a market panic or capital outflows. The yuan has been steady for the year, but pressure has been building due to weak economic growth. That could change after the recent stimulus measures in the country.

Ken Chung, chief Asian FX strategist at Mizuho Bank, told Reuters:

“The PBOC may allow further yuan depreciation. The PBOC is focusing on slowing the pace of yuan depreciation — rather than defending a particular level — against the backdrop of a higher-for-longer dollar rate environment.”

Overseas investors may look to invest in property, and fund managers have been launching new Chinese funds to take advantage of the yuan’s weakness. Global fund launches in China have hit a record high, with eleven funds launching this year under the Qualified Domestic Limited Partner (QDLP) program. That figure is already higher than any previous year.

Recent data also showed fund flows back into China-focused ETFs listed on the New York Stock Exchange.