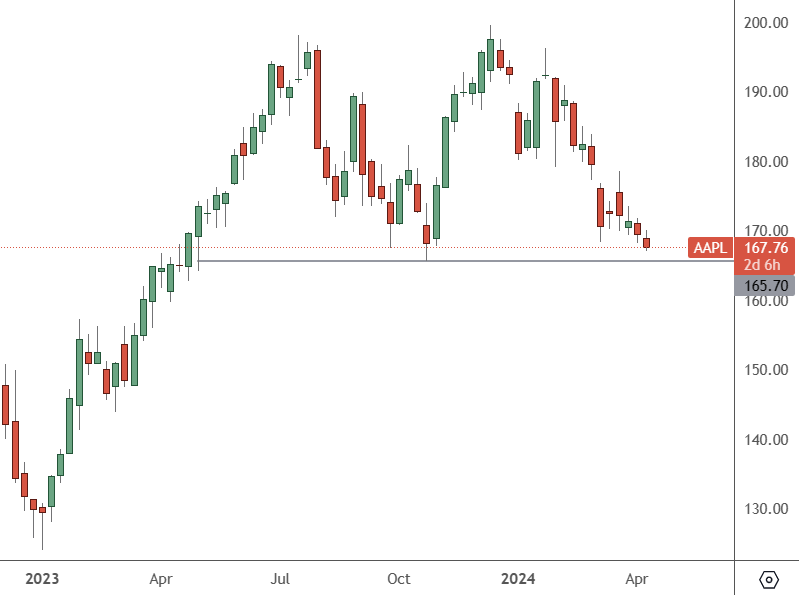

Apple’s shares are down around 10% year-to-date, but some analysts are hopeful of a turnaround in the year’s second half.

AAPL – Weekly Chart

AAPL’s crucial support level looms around $165.50, determining the stock’s path over the coming weeks. The market will likely attempt to test this over the next week, with support starting at $150.

Apple has suffered from a decline in iPhone sales in China, its key overseas market. Market share gains from domestic rivals and geopolitical tensions have added to Apple’s problems.

Wedbush Securities analysts are still bullish on Apple but pointed to a “black cloud” hanging over the company after it lost over $200 billion in market value in 2024.

But the stock still has a chance to recover this year, analysts said, maintaining their “outperform” rating with a $250 price target, the highest on Wall Street.

The company singled out some reasons it could do well, with iPhone sales potentially stronger overall. Wedbush said the 2024 estimates are “hittable” despite some conservative 2025 estimates for iPhone sales.

They also see the potential for pent-up demand for iPhones, as many users are due for an upgrade. Wedbush estimated that around 270 million iPhones could be swapped out for a newer version, especially with the iPhone 16 being released later this year.

Services revenue was a highlight, with record revenue over the first quarter, according to its latest earnings. That is expected to continue after installed devices hit a record of 2.2 billion in Q1.

The other highlight could be an announcement of AI-related tools at the company’s Worldwide Developer Conference 2024, scheduled for 10 June.

The company is developing a handheld AI tool similar to ChatGPT and other competitors. These developments could boost the company’s stock in the year’s second half. However, it must hold the looming support level or risk being dragged lower to as low as $150.