Alibaba, a global leader in AI services, experienced a significant 3% decrease in value on Tuesday. This directly resulted from the company’s strategic decision to reduce prices for some of its flagship large language models. These models, widely used in natural language processing and machine learning, form a crucial part of Alibaba’s AI services portfolio, making this move a significant event in the AI market.

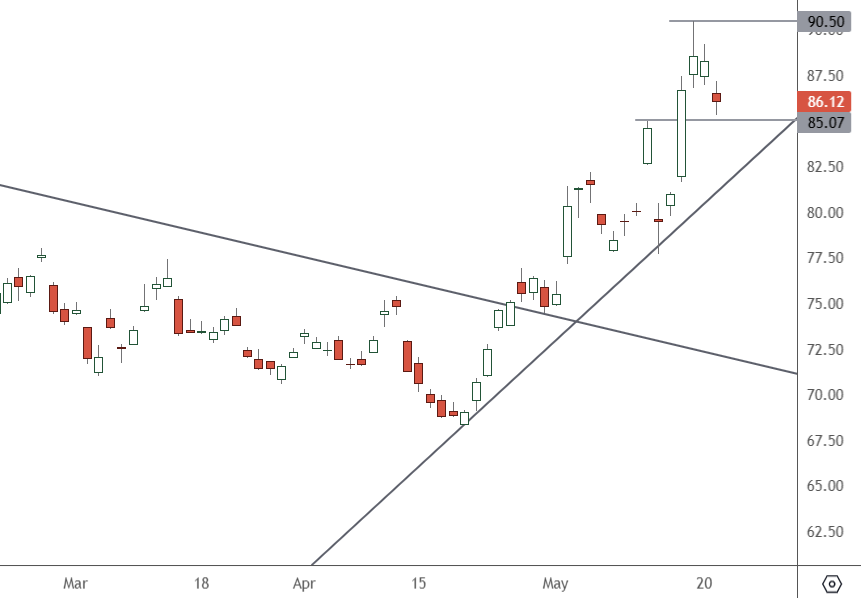

BABA – Daily Chart

BABA ADR shares were trading at $86.12 on Tuesday with support at $85, which could protect the uptrend support line.

Alibaba’s decision to slash prices for a range of its AI services, with some reductions as steep as 97%, has ignited a fierce price war among Chinese AI companies. The impact was immediate, with Baidu Cloud announcing free services for basic versions of its Ernie AI models mere hours after Alibaba’s move.

Last week, TikTok parent company, ByteDance, revealed its own AI services pricing, claiming that they were up to 99% cheaper than the Chinese industry standard. Alibaba was the first to cut its prices, and other companies have followed.

While not entirely unexpected, the price cuts highlight the intense competition among Chinese tech firms. These companies have a history of aggressive discounting across various markets to maintain their competitive advantage. However, there are valid concerns that such drastic price reductions could compromise the quality of AI services. Alibaba’s recent series of price cuts in cloud computing, with discounts of up to 55% on over 100 domestic services, has triggered similar reactions from its competitors.

Analysts at Bloomberg Intelligence are sounding the alarm, warning that this escalating tech war could disrupt China’s AI market and set off a broader price war across other services and countries. Such a development could have far-reaching implications for US companies and the stock markets‘ AI-led bubble, introducing a new level of uncertainty and risk.

Companies may be less able to spend money on high-end chips and data centre services if end users provide less monetary value.

The largest tech companies in the world have been racing to develop large language models, a key component of AI innovation. This is the first sign of weakness in demand and price pressures, which could slow the pace of innovation in this field. However, it could also lead to increased accessibility and adoption of large language models, stimulating further innovation in other areas of AI.