Key Takeaways

|

Markets enter 2026 amid a rare convergence of policy uncertainty, political pressure, and a looming leadership change at the US Federal Reserve. Jerome Powell’s term as Fed Chair ends in May 2026, a transition markets have long anticipated. Combined with a late-cycle economy and shifting rate expectations, this backdrop has created a complex and highly tradable macro environment.

Following a December 2025 rate cut, the Federal Reserve held interest rates steady at the January 27–28 FOMC meeting, maintaining the target range at 3.50%–3.75%. The decision was not unanimous, with Governors Christopher Waller and Stephen Miran dissenting in favour of a 25 basis point cut. While policymakers reiterated a cautious stance amid persistent inflation and mixed labour data, the FOMC statement removed references to downside risks to employment and signalled a firmer assessment of economic activity.

Markets are now focused on the Fed’s forward guidance and how the upcoming leadership transition may shape US monetary policy beyond 2026.

January 2026 FOMC Meeting: What the Market Is Pricing In

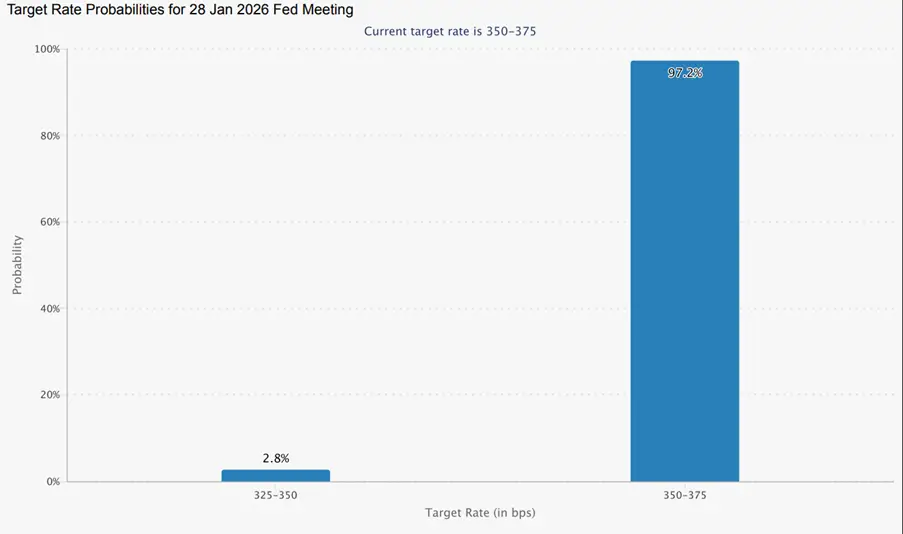

The January 27–28, 2026 FOMC meeting confirmed market expectations with no change to interest rates. Policymakers remain cautious, awaiting clearer inflation and labour data before further adjustments, though persistent inflation may delay rate cuts. Looking ahead to the March 17–18 meeting, early February data, including CME FedWatch (see chart below), indicate about a 91.1% probability of another hold at 3.50% to 3.75%, reflecting continued market confidence in policy stability.

Source: CME FedWatch

Importantly, markets are more focused on the tone of forward guidance than the decision itself, with asset prices increasingly reacting to subtle shifts in Fed communication rather than headline rate moves:

- US dollar: The dollar remains highly sensitive to changes in policy language. Dovish signals or acknowledgements of downside risks tend to weaken the USD, while emphasis on inflation persistence or policy discipline trends to support it.

- Gold: Gold prices recently dropped sharply, falling more than 10%, as markets reacted to the nomination of Kevin Warsh and expectations for a stronger dollar amid hopes of reduced policy uncertainty. However, gold remains sensitive to ongoing political risk and Fed independence concerns.

- Indices and bonds: Risk assets respond to perceived shifts in the rate path, with indices generally supported by a softer Fed stance and bonds reacting to expectations around the pace of future cuts.

In this environment, traders are positioning not for a surprise rate change, but for shifts in how the Fed frames risks to growth, inflation, and financial stability.

Powell’s Exit and the Fed Chair Succession Question

Although Powell will remain on the Board of Governors beyond mid-2026, his departure as Fed Chair marks a significant turning point for markets. Leadership transitions at the Fed often bring changes in policy bias, communication style, and tolerance for political pressure.The succession moved from speculation to official action when President Donald Trump nominated former Fed Governor Kevin Warsh on January 30, 2026. Warsh, viewed as more hawkish and continuity oriented and likely to support the US dollar while limiting aggressive easing, has sparked political battles in the Senate, with some Democratic senators seeking to delay confirmation pending a Department of Justice investigation into Powell.

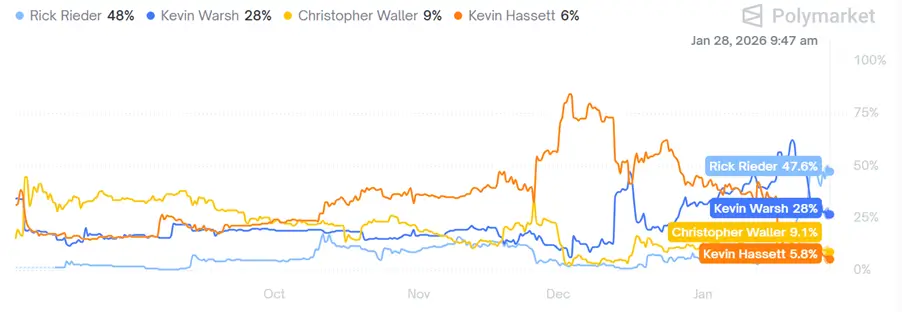

While other contenders like Rick Rieder and Kevin Hassett were in the running, market focus has now shifted firmly to Warsh amid ongoing political uncertainty. Beyond policy leanings, concerns about Fed independence and rising political rhetoric have heightened market sensitivity to the risk of politicization, which could amplify volatility across asset classes.

Source: Polymarket – Who will Trump nominate as Fed Chair?

This uncertainty is reflected in prediction markets like Polymarket (see chart above). Although Kevin Warsh is now the official nominee, market sentiment fluctuated significantly before the nomination due to political news and macro developments. Traders should treat these probabilities as fluid indicators rather than fixed forecasts.

Political Risk and the Powell Investigation Overhang

Adding another layer of uncertainty is an ongoing criminal investigation by the U.S. Department of Justice involving Jerome Powell, linked to his testimony about the Federal Reserve’s $2.5 billion headquarters renovation. Although no charges have been filed, the investigation remains active and has heightened political tensions. Some senators are blocking Fed nominations until the probe is resolved, increasing market sensitivity to the risk of Fed politicization and volatility across asset classes.

Historically, perceived threats to central bank credibility tend to spur short-term risk aversion. Reports of the investigation coincided with initial declines in US index futures, increased demand for gold as a safe haven, and heightened volatility in currency markets. Market reactions have been uneven as investors reassess the potential policy impact.

This investigation represents a short-term tail risk that can amplify market responses to routine economic data or Fed communications, especially if further legal or political developments arise.

Trading Implications for February 2026

With the January FOMC meeting, Powell succession headlines, and political developments converging, February is set to see elevated volatility driven largely by headlines rather than macro data alone.

- US dollar: The dollar remains the primary transmission channel for Fed-related uncertainty. A dovish succession outcome or increased political pressure on the Federal Reserve could keep the USD on the defensive, while signs of continuity or a hawkish nominee like Warsh may provide support.

- Gold and safe havens: Gold remains well-positioned to benefit from uncertainty around Fed independence, political risk, and falling real yields but has recently experienced sharp price corrections.

- Indices: Indices are likely to experience rotation rather than sustained trends, as investors reassess valuations across different policy scenarios. Growth-heavy and technology-weighted indices remain particularly sensitive to hawkish surprises or renewed concerns around Fed credibility.

Traders should expect sharper intraday moves and rapid sentiment swings driven by political and policy headlines. For example, confirmation delays, renewed political pressure on the Federal Reserve, or more dovish policy signals could weaken the US dollar, support gold, and press US yields. Conversely, headlines reinforcing Kevin Warsh’s confirmation prospects or signalling a more hawkish policy stance may support the USD, weigh on gold, and trigger rotation away from growth-heavy indices.

How Traders Can Navigate These Events

In periods of heightened macro uncertainty, discipline and preparation are critical:

- Monitor macro data releases and Fed communication closely ahead of key events.

- Trade post-event reactions with confirmation rather than attempting to pre-empt outcomes.

- Use wider stops and reduced position sizes to manage volatility.

- Apply scenario planning: a dovish Fed combined with succession uncertainty typically weakens the USD and supports risk assets, while a hawkish or continuity-driven outcome favours the dollar and pressures indices.

- Monitor legal and political headlines tied to the Powell investigation and Warsh’s confirmation process, as sudden developments could trigger temporary USD weakness, gold spikes, and sharp equity pullbacks even in the absence of new macro data.

Jerome Powell’s departure as Fed Chair marks a major macro inflection point for markets in 2026. Rather than predicting outcomes, traders are focused on how shifts in guidance, credibility, and leadership reshape risk across asset classes. With careful preparation and disciplined execution, the volatility surrounding the Fed’s crossroads can transform from uncertainty into a strategic opportunity.

How ATFX Supports Traders

ATFX provides traders with the tools and resources needed to navigate complex macro-driven markets. These include real-time news and analysis, advanced charting tools, and access to a wide range of CFD instruments across forex, commodities, and indices. Risk management features such as stop-loss orders and negative balance protection help traders manage downside risk, while ongoing education and webinars align trading strategies with major macro events.

With key Fed decisions, nomination headlines, and political risk events converging, ATFX’s economic calendar and market alerts help traders stay ahead of sudden volatility across USD pairs, gold, and major indices.