Super Micro Computer (SMCI) shares were dumped on Wednesday after the company’s auditor resigned.

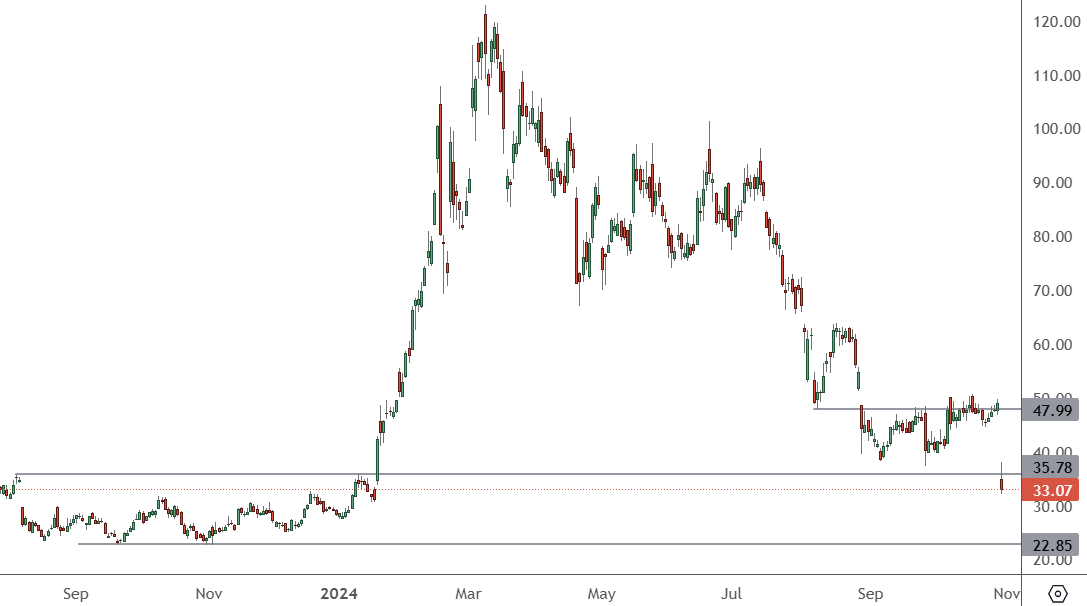

SMCI – Daily Chart

The price of SMCI has slumped from resistance near the $50 level and has pushed lower to $33. The early market action showed SMCI opening at $31 and a $30 test is likely. Larger resistance comes in at $22.85.

The share price is now down almost 40% after the company’s auditor Ernst & Young resigned. The company had problems in late August after delaying the filing of its annual report, as it needed to assess “its internal controls over financial reporting”. That followed a negative short report from Hindenburg Research which disclosed a short position accusing the company of “accounting manipulation”.

Super Micro said on Wednesday that EY had raised concerns about its governance, transparency, and financial reporting. The auditor then appointed a special committee to investigate the matter. The accounting firm has now resigned after receiving additional information from the review.

“We are resigning due to information that has recently come to our attention which has led us to no longer be able to rely on management’s and the Audit Committee’s representations and to be unwilling to be associated with the financial statements prepared by management,” EY said.

Super Micro said it disagreed with the accounting firm’s decision and does not expect the “resolution of any matters raised by EY” to result in problems with the quarterly reports for fiscal 2024 or prior years.

Super Micro was a big winner from the generative AI boom as businesses ramped up spending to power new applications. The company saw its market value surging from around $4.4 billion at the beginning of 2023 to a March peak of $67 billion, before suffering a drop in recent months.

“As far as auditor statements go, E&Y’s SMCI resignation letter is about as strongly worded as I have seen,” the founder of Hindenburg said on X after hearing the news. The Wall Street Journal reported in late September that the US Department of Justice was also investigating Super Micro over claims that it supplied chips to countries that were on a US sanctions list.

Super Micro now releases its latest earnings next week and that could add further volatility to the shares.