台积电公布优于预期的业绩后,股价再次上涨。

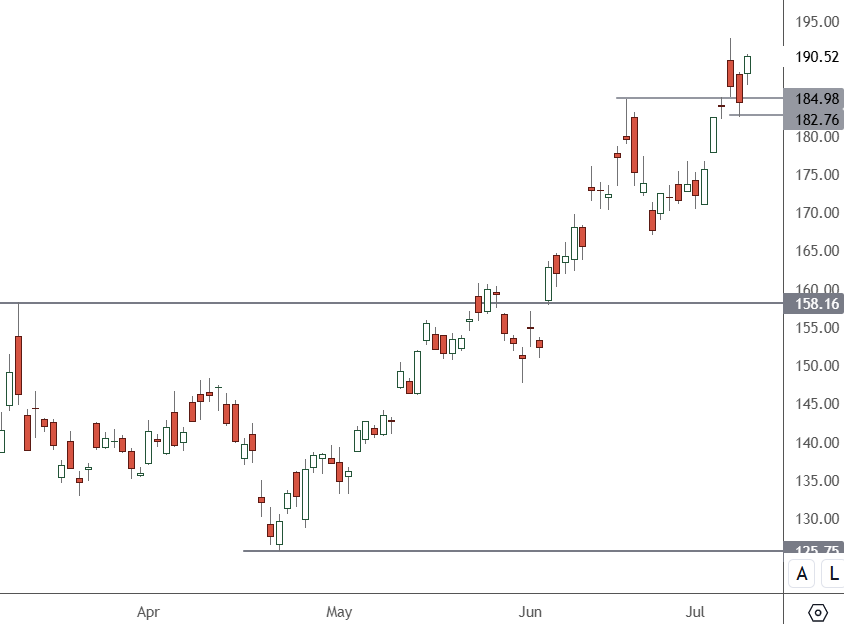

台积电-日线图

台积电在纽约证交所的价格已升至190美元上方,支撑位在185美元下方。

台积电是苹果和英伟达的重要供应商,并从人工智能驱动的销售中获得了提振。

这些销售数据表明,市场对高端芯片的需求依然强劲。台积电的消息也提振了其他芯片和科技股的股价。英伟达、苹果、AMD和芯片ETF都出现了上涨。

瑞穗分析师Jordan Klein认为,在6月份软件类股表现优于其他股票之后,投资者的最新动向似乎是重新转向科技硬件类股。

克莱因写道:“我对投资者情绪和2024年投资人工智能的了解是,这是一个FOMO(害怕错过)驱动的市场……因此,当你看到任何东西因为人工智能相关的资本支出而变得更好或听起来更好时,随着资金涌入做多,股票会瞬间重新估值。”他指出,这“感觉有点像恐慌轮换”。

台积电表示,6月份收入为新台币2078.7亿元(合63.8亿美元),较上年同期增长33%。第二季度销售额飙升40%,至6735.1亿新台币(合206.8亿美元)。

第二季度销售额超过公司预期的196亿美元至204亿美元。该公司将于7月18日正式公布第二季度收益,预计营业利润率为40%至42%。

该公司没有增加收入细目。然而,Wedbush分析师Matt Bryson表示,这似乎是由服务器驱动的。

“我们正在提高对2026年的定价假设,以解释价格似乎温和上涨的情况。这种改善加上我们对高性能计算需求将保持强劲的预期,导致我们提高了2025年的收入、利润率和每股收益预期。”

有关芯片股的FOMO因素的评论凸显了购买它们的风险。然而,高盛的一份分析报告称,“人工智能的基本面故事不太可能持续下去……人工智能泡沫可能需要很长时间才能破裂。”

分析师们讨论了人工智能制造商创造一种尚未出现的商业产品的能力。