S&P 500 futures fall 1%; Netflix, J&J earnings eyed this week.

US equity futures slide on Monday evening as President Donald Trump’s weekend threat to slap tariffs on European nations over Greenland rattled investors already on edge ahead of a packed earnings calendar.

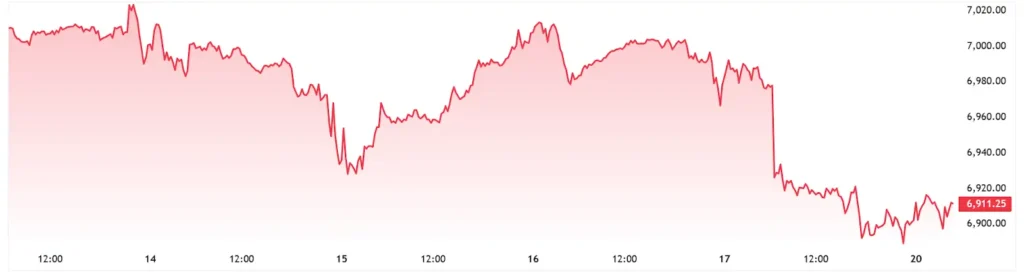

S&P 500 contracts dropped 1% to 6,908.0 points as of 6:51 p.m. in New York. Nasdaq 100 futures declined 1.2% to 25,382.0, while Dow Jones Industrial Average contracts fell 0.9% to 49,127.0. Trading was thin with US markets closed for the Martin Luther King Jr. Day holiday.

The retreat extended Monday’s global selloff triggered by Trump’s announcement that he’ll impose duties of up to 25% on several European countries until Denmark hands over Greenland. The levies would start at 10% in early February and jump to 25% if no deal is reached by July, the president said.

Trump’s push for the Danish territory, reportedly motivated in part by his failure to win a Nobel Peace Prize, drew swift condemnation from European leaders. Asked by NBC News whether he’d use military force to seize Greenland, Trump on Monday declined to rule it out.

“The geopolitical uncertainty is clearly weighing on risk assets,” said Jane Chen, portfolio manager at Global Allocation Partners. “Investors are trying to gauge whether this is another negotiating tactic or if Trump will actually follow through.”

European nations are mulling retaliatory measures, according to people familiar with the matter. Gold surged to record highs Monday as traders sought haven assets.

The key question for markets: Will Trump proceed with the tariffs or back down, as he has with several of his 2025 threats? Still, investors remain wary of potential military action following the US incursion in Venezuela earlier this year.

Earnings in Focus

Attention shifts this week to December-quarter results, with Netflix Inc. and Johnson & Johnson kicking off earnings Tuesday and Wednesday. Also reporting: 3M Co. and US Bancorp on Tuesday; Charles Schwab Corp., Prologis Inc. and Halliburton Co. on Wednesday.

Later in the week, investors will parse reports from GE Aerospace, Intel Corp., Procter & Gamble Co. and Abbott Laboratories for clues on corporate health after mixed results from big banks last week.

Despite recent choppiness, futures remain close to all-time highs following a tech-fueled rally through late 2025 and early 2026.