Cryptocurrency prices and Hong Kong stocks slumped after Beijing said it would crack down on stablecoin issuers.

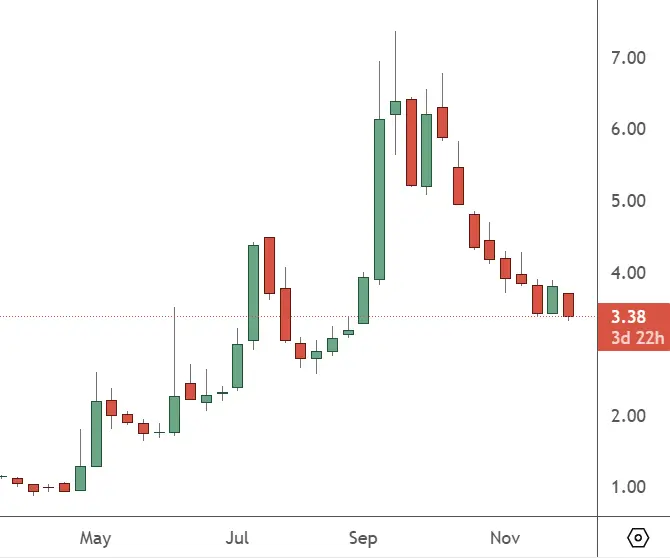

376 – Daily Chart

Yunfeng Securities (HK:376) was down 10% after the news, highlighting the risk to companies involved in crypto. Despite this, the stock is still up 225% year-to-date. Clarification from China could see further losses.

Hong Kong-listed stocks related to stablecoins were lower on Monday after China’s central bank said it would scrutinize virtual currencies and flagged stablecoin concerns. Alongside, Yunfeng Financial, Bright Smart Securities and Commodities Group dropped roughly 7%.

The People’s Bank of China (PBOC) reaffirmed its plans for a tough stance on cryptocurrencies, warning of a resurgence in speculation and vowing to tackle illegal activities involving stablecoins. The PBOC specifically said that stablecoins fail to meet requirements for customer identification and anti-money-laundering.

“Virtual currencies do not have the same legal status as fiat currencies, lack legal tender status, and should not and cannot be used as currency in the market,” the bank said.

The latest news also hurt crypto across the board, with Bitcoin down 5% over the last 24 hours.

China’s central bank previously banned crypto trading and mining in 2021, noting a need to crack down on crime and risks to the financial system. In August this year, China’s financial regulators had instructed brokers to cancel seminars and halt the promotion of research on stablecoins, due to concerns that they could be exploited as a tool for fraud.

Hong Kong moved toward licensing stablecoin issuers in July, but some tech companies suspended their own plans to launch stablecoins after Chinese regulators were said to have intervened to pause any coin launches.