PDD Holdings (NYSE:PDD) will release earnings on Thursday after the company surrendered its stimulus-led gains.

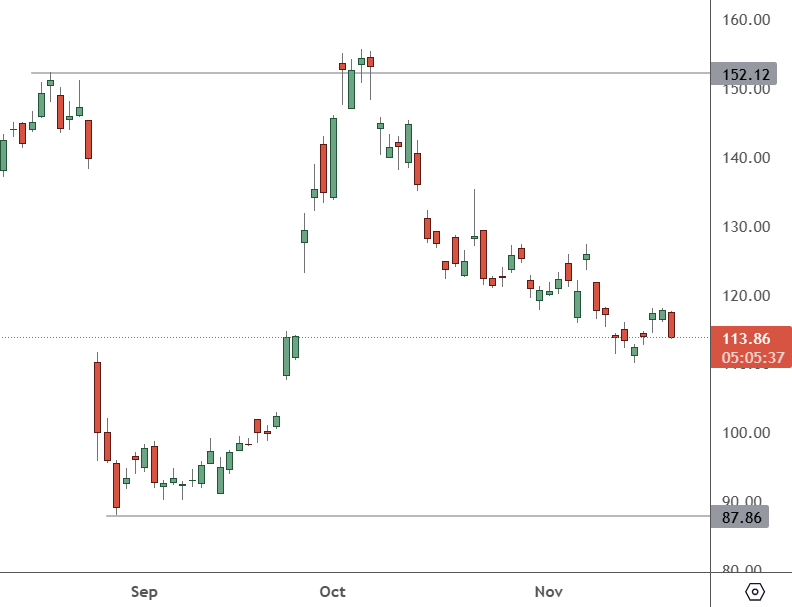

PDD – Daily Chart

After a recent price surge above $152, the price of PDD shares have slumped back to $114.72 and risk moving back toward the lows if earnings disappoint. A move above $120 could open up a return to higher levels.

PDD Holdings is a new top e-commerce pick at Morgan Stanley, the Wall Street firm announced recently. Analysts said the company’s potential to sustain higher growth and gain market share in 2025 and 2026 was the reason for the upgrade.

Revenue is expected to come in at 102.43 billion yuan, which would be sharply higher than 68.84 billion yuan a year ago. The company’s American depositary receipts fell by a record 28.5% in one day in August after posting weaker-than-expected revenue growth for the second quarter and warned of significant challenges.

The company’s TEMU bargain app faces various headwinds despite robust growth since first launching in the US in 2022, analysts said. There is uncertainty over the potential for tariffs and greater pushback from countries on low prices, Citi analysts wrote. Haitong International also noted geopolitical risk as a key factor for PDD’s stock price in the coming month, although it is unclear at this stage how Donald Trump’s tariff policy will affect the company’s business.

PDD management has been able to deliver strong execution and its domestic gross merchandise value and revenue growth will still outperform peers despite the rise in competition, Citi added. GMV growth of 15% to 20% is expected in the company’s domestic market for the third quarter.

Hedge fund billionaire David Tepper is still a fan of the company with 10.62% of his portfolio invested in a $714.6 million PDD stake. His latest regulatory filing showed a sharp 173.25% increase in shares to add 6.73% of his portfolio to PDD.