Market Highlight 30/10/2025

The Federal Reserve cut interest rates on Wednesday amid internal disagreements, with Chair Jerome Powell hinting this may be the last cut of the year. He emphasized uncertainty about the actual state of the economy due to missing official data resulting from the government shutdown. U.S. equities closed mixed: the Dow Jones Industrial Average fell 0.16%, the S&P 500 edged down slightly, while the Nasdaq gained 0.55%. The U.S. dollar rose as Fed officials struggled to reach a consensus on future monetary policy. The dollar index ended up 0.63% at 99.28; EUR/USD fell 0.56% to 1.1585.

Gold prices retreated after Powell’s remarks. Although the Fed lowered rates by 25 basis points as expected, markets digested his comments on the uncertain policy path ahead. Spot gold closed at $3,929.36 per ounce, down 0.56%, after earlier gaining as much as 2%. Oil prices rebounded 0.3%, supported by data showing U.S. crude and fuel inventories fell more than expected last week.

Key Outlook 30/10/2025

The Bank of Japan will announce its rate decision today. The election of Sanae Takaichi as Prime Minister has added new uncertainty to the BOJ’s monetary policy outlook. Governor Kazuo Ueda has recently shown greater caution about raising rates, leaving markets to delay expectations of further tightening. Traders will closely monitor the BOJ’s latest rhetoric. Later tonight, attention shifts to the European Central Bank decision, where rates are expected to remain unchanged for the third straight time. Most analysts believe the ECB has ended its rate-cutting cycle. Still, President Christine Lagarde’s comments will be critical for shaping the policy roadmap ahead, influencing both the euro and European equities.

Key Data and Events Today

- 11:00 BoJ Interest Rate Decision ***

- 14:30 BoJ Gov Ueda Press Conference ***

- 16:55 EU GERMANY Unemployment Rate OCT **

- 17:00 EU GERMANY GDP QoQ Flash Q3 ***

- 18:00 EU GDP YoY Flash Q3 ***

- 18:00 EU Unemployment Rate SEP **

- 21:00 EU GERMANY CPI YoY Prel OCT **

- 21:15 ECB Interest Rate Decision ***

- 21:45 ECB Press Conference ***

Tomorrow:

- 07:30 JP Unemployment Rate SEP **

- 07:50 JP Industrial Production MoM SEP **

- 08:30 AU PPI QoQ Q3 **

- 09:30 CN Manufacturing PMI OCT **

- 15:00 EU GERMANY Retail Sales MoM SEP **

- 18:00 EU CPI YoY Flash OCT **

- 20:30 CA GDP MoM AUG **

Markets Analysis 30/10/2025

EURUSD

- Resistance: 1.1633/1.1647

- Support: 1.1575/1.1564

EUR/USD slipped to 1.1585 (-0.56%) as Powell’s hawkish tone lifted the dollar. Price action remains capped by the descending trendline, with short-term rebounds struggling near 1.1633. If momentum fades, a retest of 1.1575–1.1564 is likely, and a sustained break could expose the mid-1.15 zone.

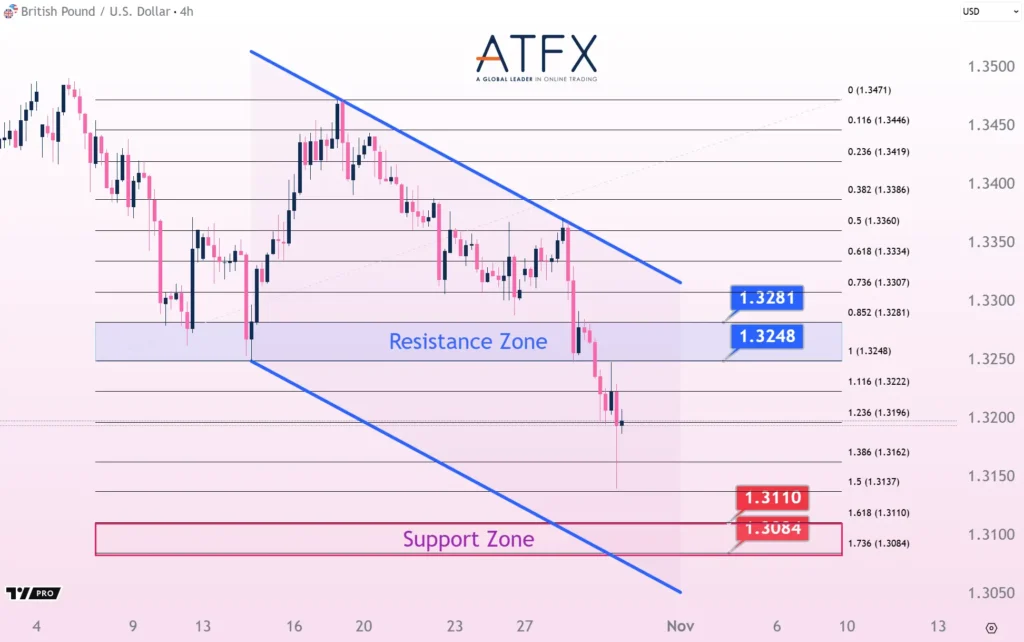

GBPUSD

- Resistance: 1.3248/1.3281

- Support: 1.3110/1.3084

GBP/USD slumped 0.9% to 1.3151, its lowest in over five months, as BoE rate-cut bets weighed on sentiment. On the charts, price remains capped by a firm descending trendline, with sellers defending the 1.3248 area. A failure to reclaim this level could see momentum drag the pair toward 1.3100, while only a decisive recovery above 1.3281 would ease bearish pressure.

USDJPY

- Resistance: 153.27/153.72

- Support: 151.79/151.33

USD/JPY touched 152.86 after the Fed, with the dollar in momentum. The pair is consolidating above 151.79 support, and buyers are testing the 153.00 barrier. A firm breakout could open the path toward 153.27, while repeated rejections may trigger a pullback.

US Crude Oil Futures (DEC)

- Resistance: 61.89/62.92

- Support: 58.63/57.62

WTI crude rose 0.6% to $60.48 after U.S. stockpiles fell more than expected. Price action is consolidating around $60, with $58.63 serving as a key floor. A break above $61.89 could fuel further upside, while failure to hold $57.62 risks a deeper retracement.

Spot Gold

- Resistance: 4008/4059

- Support: 3840/3775

Spot Silver

- Resistance: 48.16/49.17

- Support: 45.90/44.91

Gold pared gains, closing at $3,964/oz (+0.3%) as Powell’s remarks dampened December cut bets. Resistance remains at $4,008, while $3,920 offers immediate support. A break lower could expose $3,840, but sustained recovery above $4,008 would ease downside risks.

Dow Futures

- Resistance: 47846/48036

- Support: 47234/47050

The Dow Future eased 0.16% to 47,632 after Powell’s hawkish tone weighed on sentiment. Support lies at 47,234, while resistance is capped near 47,846. A bounce from support could retest highs, but failure to hold risks a deeper pullback.

NAS100

- Resistance: 26296/26414

- Support: 25921/25805

NAS100 gained 0.55%, driven by Nvidia’s 3% surge to a record $5 trillion valuation. On the charts, the index trades around 26,120, with immediate support near 25,921, a zone buyers have defended. A “W-shaped” rebound pattern could pave the way toward 26,296 resistance, while a break below support may trigger renewed downside risks.

BTC

- Resistance: 113404/114939

- Support: 107008/105524

Bitcoin eased to around $111.9k, with markets cautious after the Fed meeting. The 4H chart shows price capped by a descending trendline, while $110k remains key support. A break below could accelerate downside toward $107,008, whereas reclaiming $113,404 would signal renewed bullish momentum.

Enjoy trading! The content is for reference only. Please ensure that you understand the risk.